Summary

The classical derivation of the well-known Vasicek model for interest rates is reformulated in terms of the associated pricing kernel. An advantage of the pricing kernel method is that it allows one to generalize the construction to the L\'evy-Vasicek case, avoiding issues of market incompleteness. In the L\'evy-Vasicek model the short rate is taken in the real-world measure to be a mean-reverting process with a general one-dimensional L\'evy driver admitting exponential moments. Expressions are obtained for the L\'evy-Vasicek bond prices and interest rates, along with a formula for the return on a unit investment in the long bond, defined by $L_t = \lim_{T \rightarrow \infty} P_{tT} / P_{0T}$, where $P_{tT}$ is the price at time $t$ of a $T$-maturity discount bond. We show that the pricing kernel of a L\'evy-Vasicek model is uniformly integrable if and only if the long rate of interest is strictly positive.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

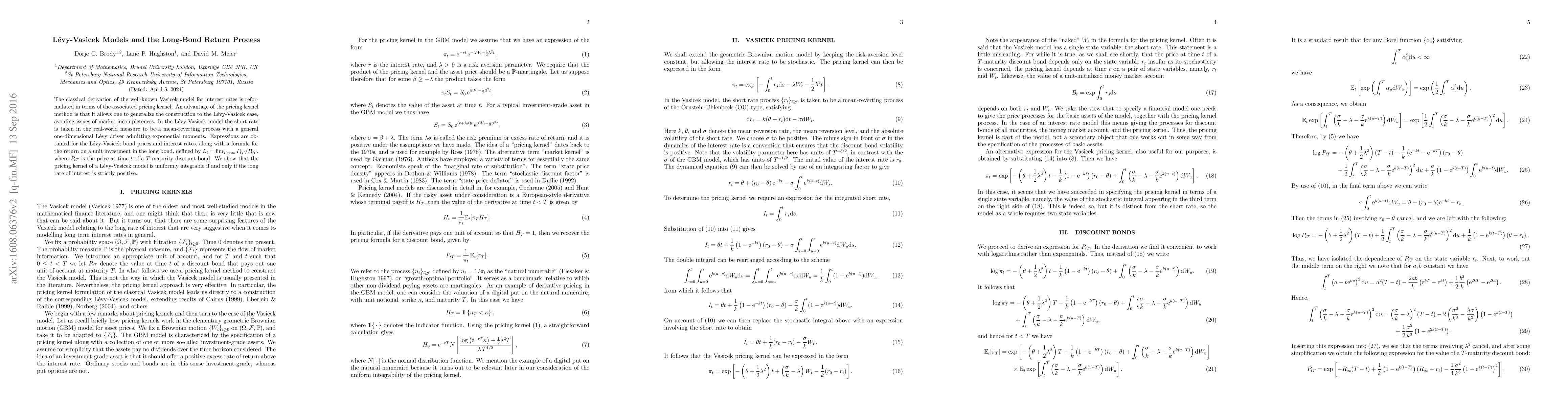

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)