Summary

This paper employs a novel Lie symmetry-based framework to model the intrinsic symmetries within financial market. Specifically, we introduce {\it Lie symmetry net} (LSN), which characterises the Lie symmetry of the differential equations (DE) estimating financial market dynamics, such as the Black-Scholes equation and the Va\v{s}i\v{c}ek equation. To simulate these differential equations in a symmetry-aware manner, LSN incorporates a Lie symmetry risk derived from the conservation laws associated with the Lie symmetry operators of the target differential equations. This risk measures how well the Lie symmetry is realised and guides the training of LSN under the structural risk minimisation framework. Extensive numerical experiments demonstrate that LSN effectively realises the Lie symmetry and achieves an error reduction of more than {\it one order of magnitude} compared to state-of-the-art methods. The code is available at \href{https://github.com/Jxl163/LSN_code}{https://github.com/Jxl163/LSN$\_$code}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

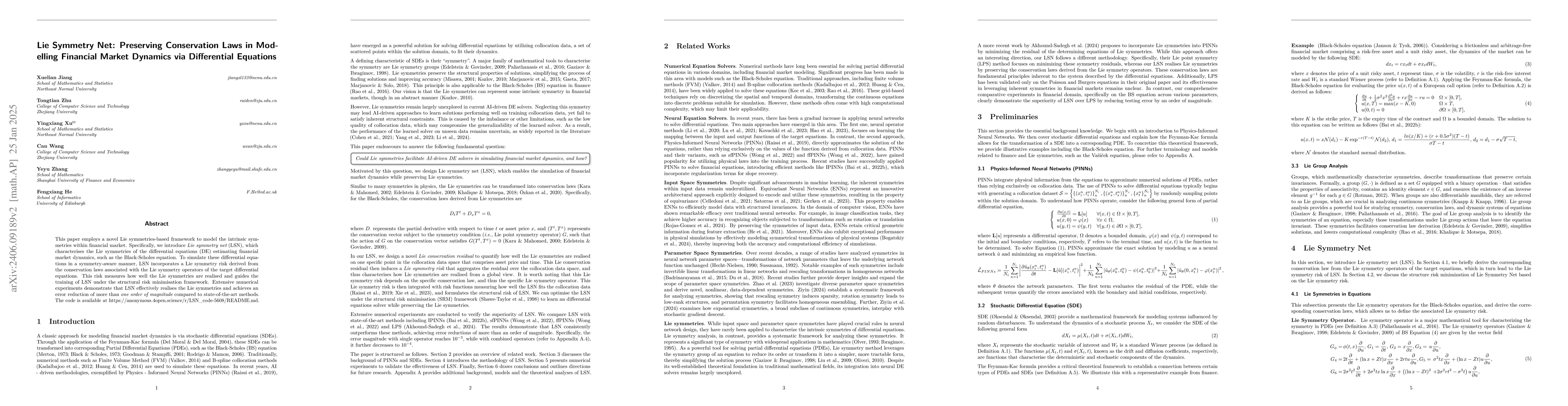

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)