Summary

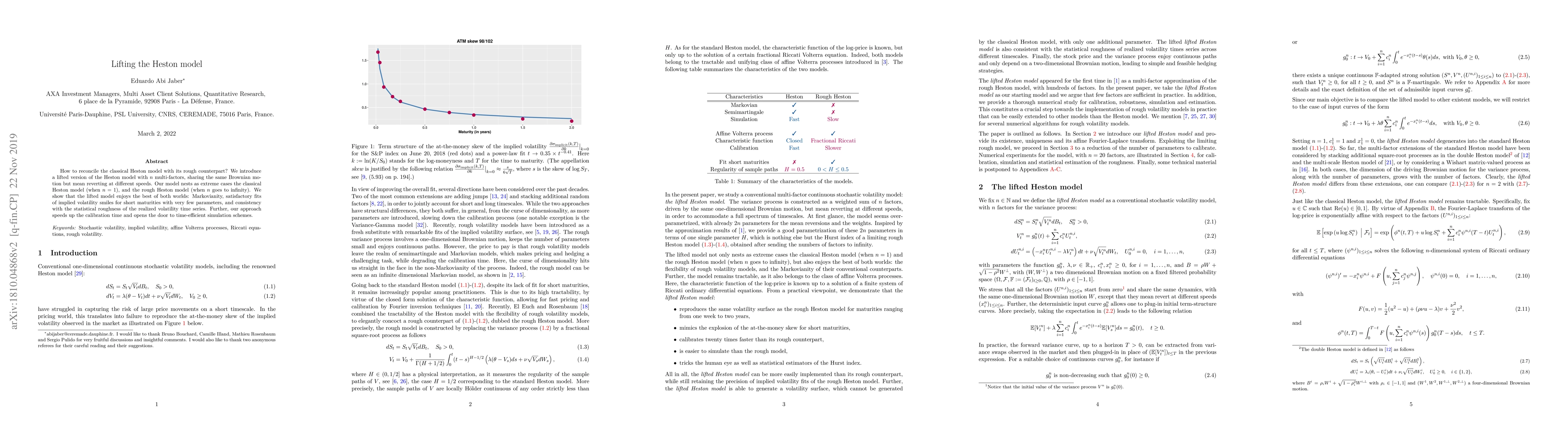

How to reconcile the classical Heston model with its rough counterpart? We introduce a lifted version of the Heston model with n multi-factors, sharing the same Brownian motion but mean reverting at different speeds. Our model nests as extreme cases the classical Heston model (when n = 1), and the rough Heston model (when n goes to infinity). We show that the lifted model enjoys the best of both worlds: Markovianity and satisfactory fits of implied volatility smiles for short maturities with very few parameters. Further, our approach speeds up the calibration time and opens the door to time-efficient simulation schemes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)