Summary

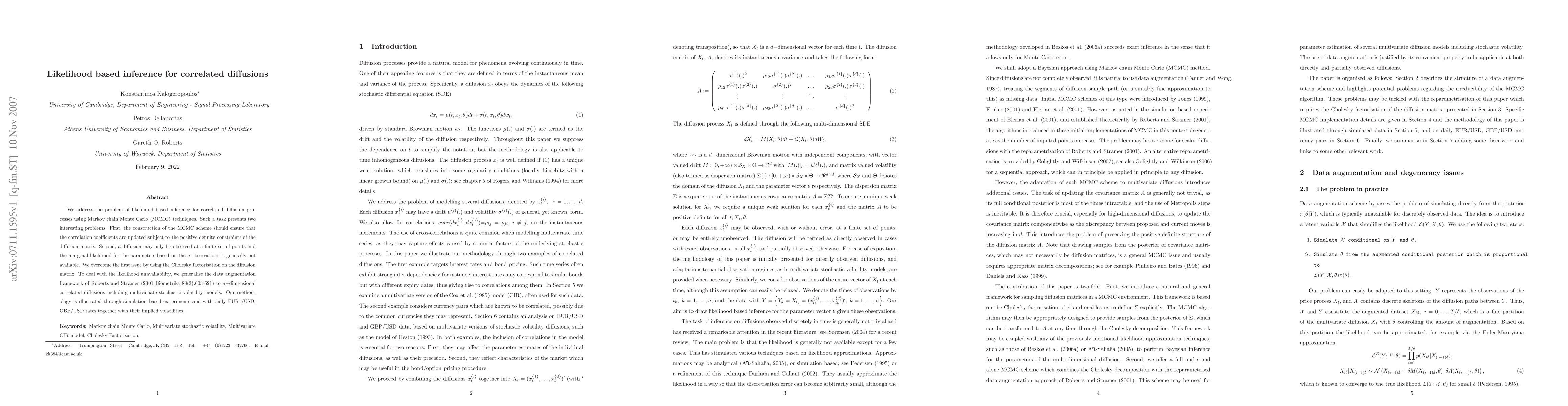

We address the problem of likelihood based inference for correlated diffusion processes using Markov chain Monte Carlo (MCMC) techniques. Such a task presents two interesting problems. First, the construction of the MCMC scheme should ensure that the correlation coefficients are updated subject to the positive definite constraints of the diffusion matrix. Second, a diffusion may only be observed at a finite set of points and the marginal likelihood for the parameters based on these observations is generally not available. We overcome the first issue by using the Cholesky factorisation on the diffusion matrix. To deal with the likelihood unavailability, we generalise the data augmentation framework of Roberts and Stramer (2001 Biometrika 88(3):603-621) to d-dimensional correlated diffusions including multivariate stochastic volatility models. Our methodology is illustrated through simulation based experiments and with daily EUR /USD, GBP/USD rates together with their implied volatilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA family of toroidal diffusions with exact likelihood inference

Eduardo García-Portugués, Michael Sørensen

Exact Monte Carlo likelihood-based inference for jump-diffusion processes

Gareth O. Roberts, Flávio B. Gonçalves, Krzysztof G. Łatuszyński

| Title | Authors | Year | Actions |

|---|

Comments (0)