Summary

Multivariate extreme value statistical analysis is concerned with observations on several variables which are thought to possess some degree of tail-dependence. In areas such as the modeling of financial and insurance risks, or as the modeling of spatial variables, extreme value models in high dimensions (up to fifty or more) with their statistical inference procedures are needed. In this paper, we consider max-stable models for which the spectral random vectors have absolutely continuous distributions. For random samples with max-stable distributions we provide quasi-explicit analytical expressions of the full likelihoods. When the full likelihood becomes numerically intractable because of a too large dimension, it is however necessary to split the components into subgroups and to consider a composite likelihood approach. For random samples in the max-domain of attraction of a max-stable distribution, two approaches that use simpler likelihoods are possible: (i) a threshold approach that is combined with a censoring scheme, (ii) a block maxima approach that exploits the information on the occurrence times of the componentwise maxima. The asymptotic properties of the estimators are given and the utility of the methods is examined via simulation. The estimators are also compared with those derived from the pairwise composite likelihood method which has been previously proposed in the spatial extreme value literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

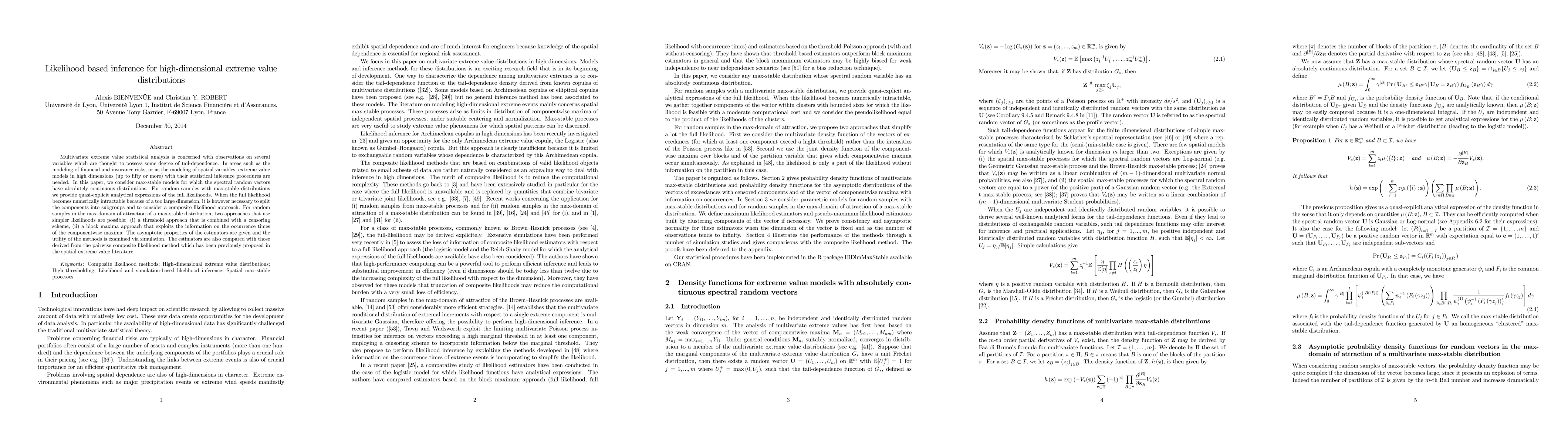

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)