Summary

We consider pure-jump transaction-level models for asset prices in continuous time, driven by point processes. In a bivariate model that admits cointegration, we allow for time deformations to account for such effects as intraday seasonal patterns in volatility, and non-trading periods that may be different for the two assets. We also allow for asymmetries (leverage effects). We obtain the asymptotic distribution of the log-price process. We also obtain the asymptotic distribution of the ordinary least-squares estimator of the cointegrating parameter based on data sampled from an equally-spaced discretization of calendar time, in the case of weak fractional cointegration. For this same case, we obtain the asymptotic distribution for a tapered estimator under more

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

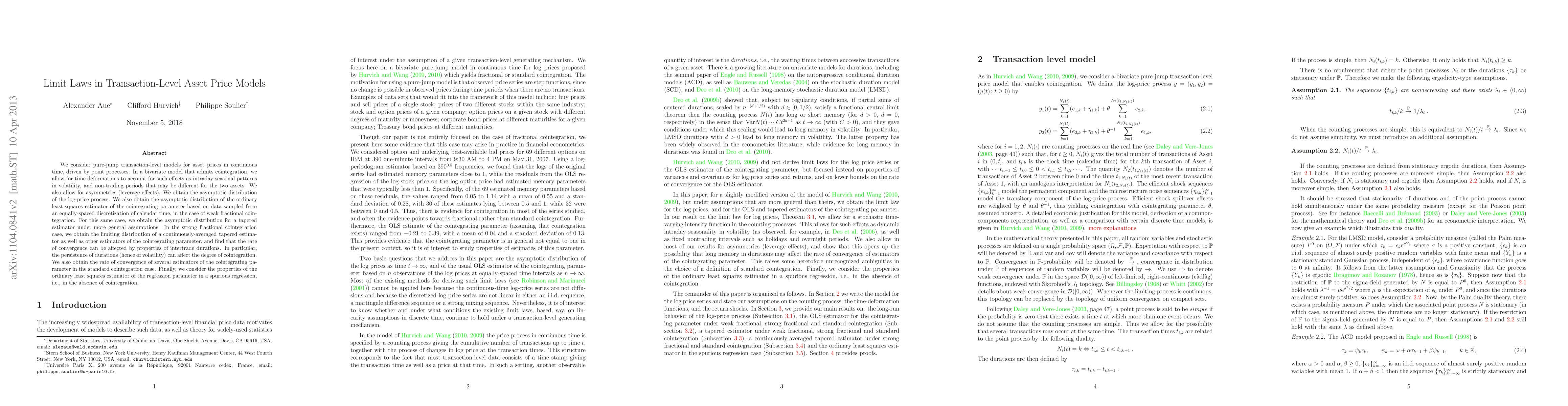

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)