Summary

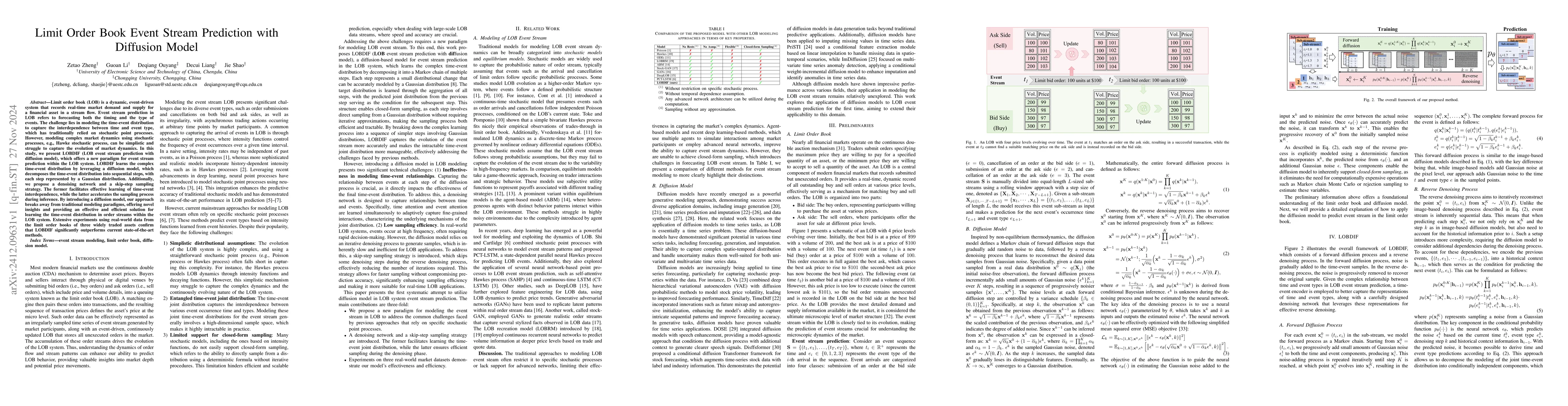

Limit order book (LOB) is a dynamic, event-driven system that records real-time market demand and supply for a financial asset in a stream flow. Event stream prediction in LOB refers to forecasting both the timing and the type of events. The challenge lies in modeling the time-event distribution to capture the interdependence between time and event type, which has traditionally relied on stochastic point processes. However, modeling complex market dynamics using stochastic processes, e.g., Hawke stochastic process, can be simplistic and struggle to capture the evolution of market dynamics. In this study, we present LOBDIF (LOB event stream prediction with diffusion model), which offers a new paradigm for event stream prediction within the LOB system. LOBDIF learns the complex time-event distribution by leveraging a diffusion model, which decomposes the time-event distribution into sequential steps, with each step represented by a Gaussian distribution. Additionally, we propose a denoising network and a skip-step sampling strategy. The former facilitates effective learning of time-event interdependence, while the latter accelerates the sampling process during inference. By introducing a diffusion model, our approach breaks away from traditional modeling paradigms, offering novel insights and providing an effective and efficient solution for learning the time-event distribution in order streams within the LOB system. Extensive experiments using real-world data from the limit order books of three widely traded assets confirm that LOBDIF significantly outperforms current state-of-the-art methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDiffusion Limit of Poisson Limit-Order Book Models

Xiaofeng Yu, Christopher Almost, John Lehoczky et al.

No citations found for this paper.

Comments (0)