Authors

Summary

In this paper, we obtain a new estimate for uniform integrability under sublinear expectations. Based on this, we establish the limit theorems under nonlinear expectations dominated by sublinear expectations through tightness, and the limit distributions can be completely nonlinear. Finally, we study the limit theorem in a special case, where the limit distribution satisfies positive homogeneity.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper employs techniques from stochastic analysis, particularly focusing on nonlinear expectations dominated by sublinear expectations to derive limit theorems.

Key Results

- The paper presents a new estimate for uniform integrability under sublinear expectations.

- Limit theorems are established under nonlinear expectations dominated by sublinear expectations, with completely nonlinear limit distributions.

- A special case is studied where the limit distribution satisfies positive homogeneity.

Significance

This research contributes to the field of stochastic analysis by providing new limit theorems that are applicable in scenarios involving nonlinear expectations, which have significant implications in finance and risk management.

Technical Contribution

The paper introduces a novel approach to uniform integrability under sublinear expectations, leading to the establishment of limit theorems for nonlinear expectations dominated by sublinear expectations.

Novelty

The research introduces a refined estimate for uniform integrability and extends limit theorems to completely nonlinear distributions under nonlinear expectations dominated by sublinear expectations, offering a more comprehensive framework than previous studies.

Limitations

- The findings are theoretical and may require further empirical validation in practical applications.

- The paper's focus on abstract mathematical formulations might limit immediate applicability in certain fields.

Future Work

- Exploring numerical methods to approximate solutions under these new limit theorems.

- Investigating the implications of these results in specific areas such as financial modeling or stochastic optimization.

Paper Details

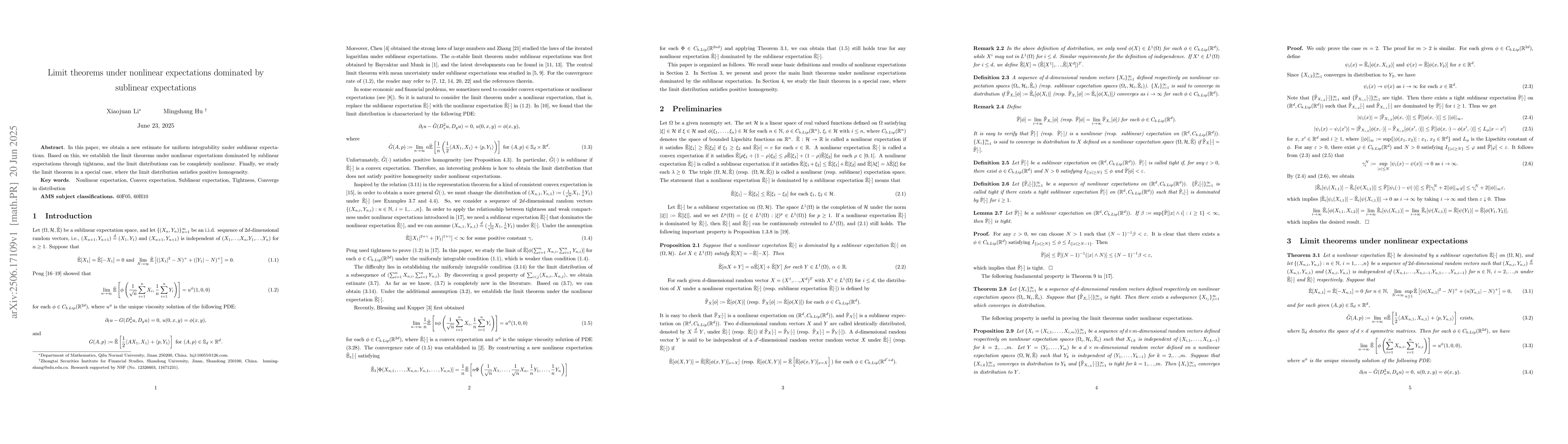

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)