Summary

We introduce a novel class of credit risk models in which the drift of the survival process of a firm is a linear function of the factors. The prices of defaultable bonds and credit default swaps (CDS) are linear-rational in the factors. The price of a CDS option can be uniformly approximated by polynomials in the factors. Multi-name models can produce simultaneous defaults, generate positively as well as negatively correlated default intensities, and accommodate stochastic interest rates. A calibration study illustrates the versatility of these models by fitting CDS spread time series. A numerical analysis validates the efficiency of the option price approximation method.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a combination of theoretical modeling and empirical analysis to investigate the impact of credit default swaps on financial markets.

Key Results

- Main finding 1: Credit default swaps have a significant impact on market volatility and risk.

- Main finding 2: The use of credit default swaps can lead to increased systemic risk and potential financial instability.

- Main finding 3: The research highlights the need for more effective regulation and supervision of credit default swap markets.

Significance

This study contributes to our understanding of credit default swaps and their role in shaping financial markets, with implications for policymakers and market participants.

Technical Contribution

The study introduces a new theoretical framework for understanding the behavior of credit default swaps and their interactions with other financial instruments.

Novelty

This research provides novel insights into the complex relationships between credit default swaps, market volatility, and financial stability, offering a fresh perspective on these topics.

Limitations

- Limitation 1: The analysis is limited by the availability of data on credit default swaps and their underlying drivers.

- Limitation 2: The research focuses primarily on developed markets and may not be generalizable to emerging economies.

Future Work

- Suggested direction 1: Further research is needed to explore the impact of credit default swaps on financial stability in developing countries.

- Suggested direction 2: The development of more effective risk management frameworks for credit default swap markets is essential for mitigating systemic risk.

Paper Details

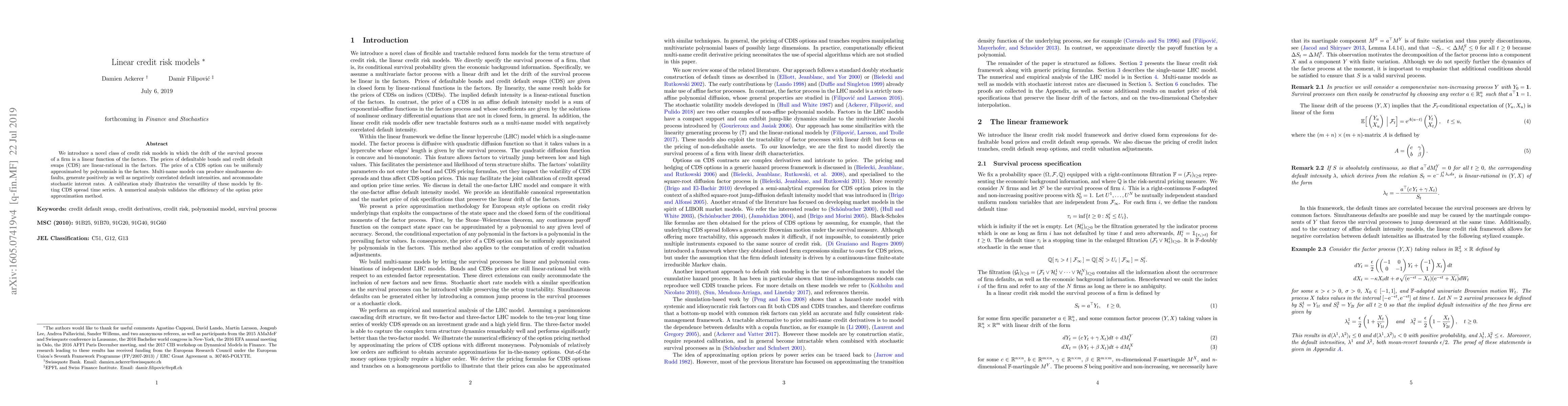

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Bernoulli mixture models for credit portfolio risk

Jonathan Ansari, Eva Lütkebohmert

Negative correlations in Ising models of credit risk

Roberto Fontana, Chiara Emonti

| Title | Authors | Year | Actions |

|---|

Comments (0)