Summary

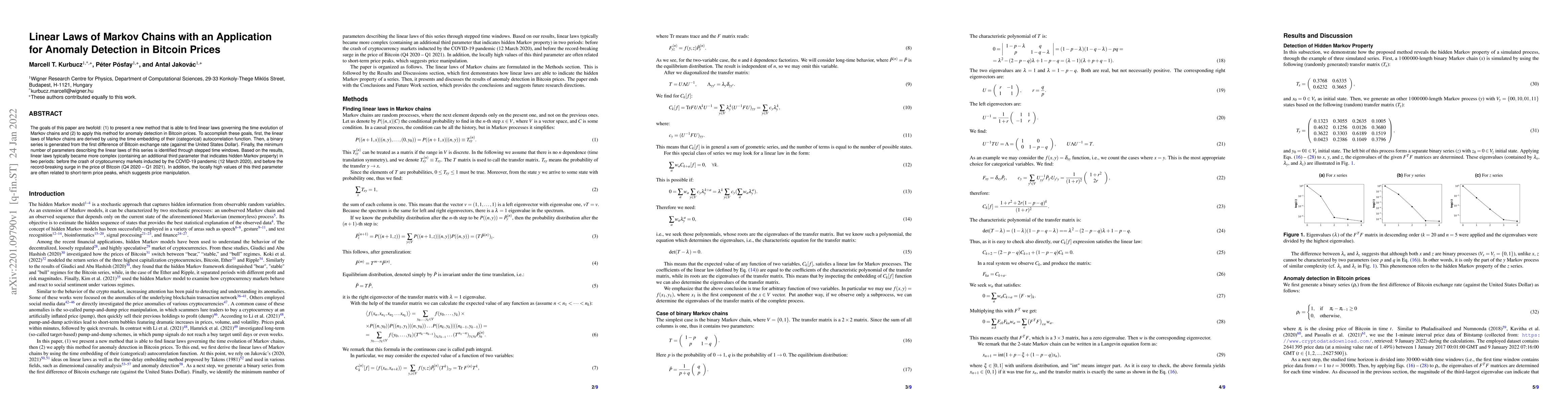

The goals of this paper are twofold: (1) to present a new method that is able to find linear laws governing the time evolution of Markov chains and (2) to apply this method for anomaly detection in Bitcoin prices. To accomplish these goals, first, the linear laws of Markov chains are derived by using the time embedding of their (categorical) autocorrelation function. Then, a binary series is generated from the first difference of Bitcoin exchange rate (against the United States Dollar). Finally, the minimum number of parameters describing the linear laws of this series is identified through stepped time windows. Based on the results, linear laws typically became more complex (containing an additional third parameter that indicates hidden Markov property) in two periods: before the crash of cryptocurrency markets inducted by the COVID-19 pandemic (12 March 2020), and before the record-breaking surge in the price of Bitcoin (Q4 2020 - Q1 2021). In addition, the locally high values of this third parameter are often related to short-term price peaks, which suggests price manipulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting the movements of Bitcoin prices: an application of machine learning algorithms

Hakan Pabuccu, Serdar Ongan, Ayse Ongan

| Title | Authors | Year | Actions |

|---|

Comments (0)