Authors

Summary

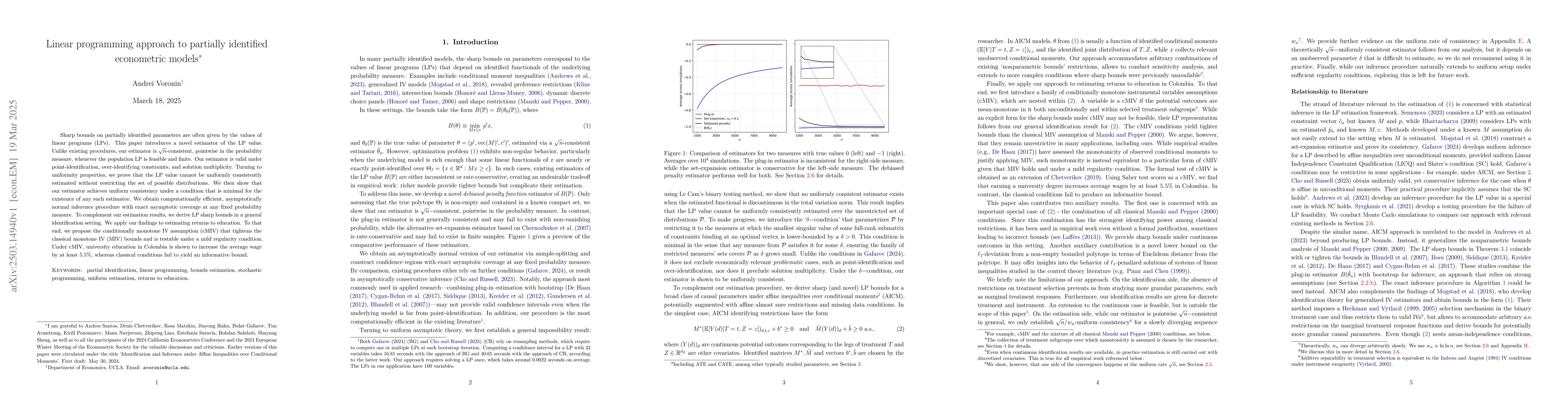

Sharp bounds on partially identified parameters are often given by the values of linear programs (LPs). This paper introduces a novel estimator of the LP value. Unlike existing procedures, our estimator is root-n-consistent, pointwise in the probability measure, whenever the population LP is feasible and finite. Our estimator is valid under point-identification, over-identifying constraints, and solution multiplicity. Turning to uniformity properties, we prove that the LP value cannot be uniformly consistently estimated without restricting the set of possible distributions. We then show that our estimator achieves uniform consistency under a condition that is minimal for the existence of any such estimator. We obtain computationally efficient, asymptotically normal inference procedure with exact asymptotic coverage at any fixed probability measure. To complement our estimation results, we derive LP sharp bounds in a general identification setting. We apply our findings to estimating returns to education. To that end, we propose the conditionally monotone IV assumption (cMIV) that tightens the classical monotone IV (MIV) bounds and is testable under a mild regularity condition. Under cMIV, university education in Colombia is shown to increase the average wage by at least $5.5\%$, whereas classical conditions fail to yield an informative bound.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces a novel estimator for the linear programming (LP) value in partially identified econometric models, utilizing a root-n-consistent approach that works under various identification conditions, including point-identification, over-identifying constraints, and solution multiplicity.

Key Results

- The proposed estimator is root-n-consistent, pointwise in the probability measure, under the assumption that the population LP is feasible and finite.

- Uniform consistency cannot be achieved without restricting the set of possible distributions, but the estimator achieves it under a minimal condition.

- Computationally efficient, asymptotically normal inference with exact asymptotic coverage at any fixed probability measure is obtained.

- Sharp bounds on partially identified parameters are derived in a general identification setting.

- Application to estimating returns to education, showing that university education in Colombia increases the average wage by at least 5.5% under the conditionally monotone IV assumption (cMIV), unlike classical conditions which fail to provide an informative bound.

Significance

This research is significant as it provides a robust and consistent method for estimating LP values in partially identified models, which are common in econometric analysis. The findings improve the reliability of causal effect estimates in educational returns studies and offer a computationally efficient inference procedure.

Technical Contribution

The paper's main technical contribution is the development of a novel, root-n-consistent estimator for LP values in partially identified models, along with a computationally efficient inference procedure that ensures exact asymptotic coverage.

Novelty

The novelty of this work lies in its introduction of a root-n-consistent estimator for LP values that works uniformly under minimal conditions, contrasting with existing procedures that lack uniform consistency without restricting the set of possible distributions.

Limitations

- The study assumes conditions such as point-identification and over-identifying constraints, which may not always hold in real-world scenarios.

- The applicability of the methodology might be limited to settings where the proposed assumptions can be reasonably met.

Future Work

- Exploring the applicability of the method in other areas of econometrics beyond returns to education.

- Investigating the performance of the estimator under more complex and varied data distributions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA robust spline approach in partially linear additive models

Graciela Boente, Alejandra Mercedes Martinez

No citations found for this paper.

Comments (0)