Summary

We propose a simple and original approach for solving linear-quadratic mean-field stochastic control problems. We study both finite-horizon and infinite-horizon problems, and allow notably some coefficients to be stochastic. Our method is based on a suitable extension of the martingale formulation for verification theorems in control theory. The optimal control involves the solution to a system of Riccati ordinary differential equations and to a linear mean-field backward stochastic differential equation, existence and uniqueness conditions are provided for such a system. Finally, we illustrate our results through two applications with explicit solutions: the first one deals with a portfolio liquidation problem with trade crowding, and the second one considers an economic model of substitutable production goods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

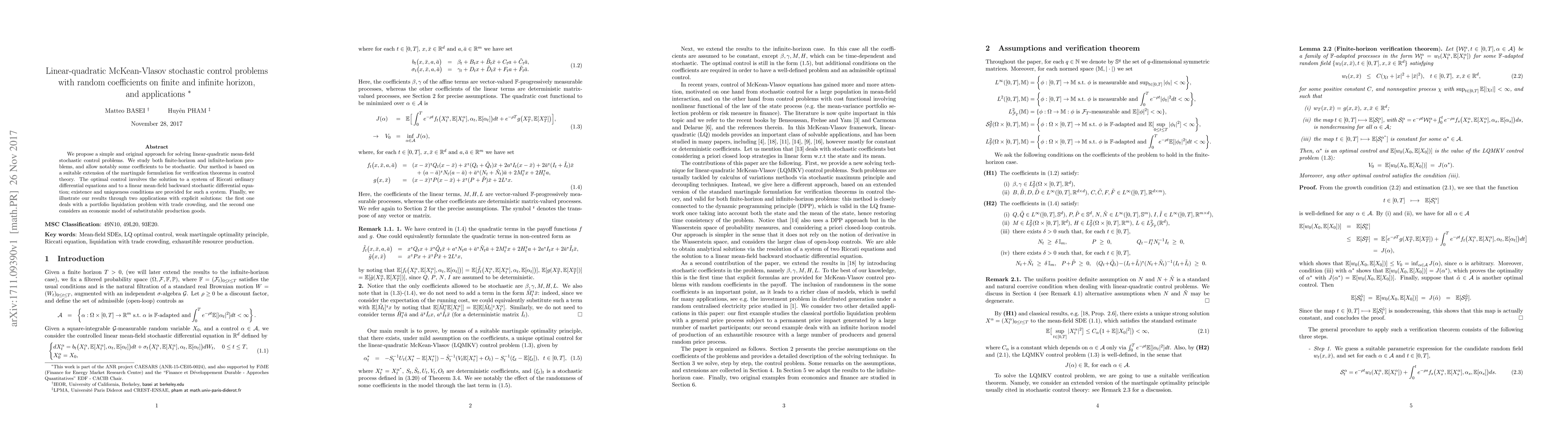

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)