Authors

Summary

This paper considers the setting governed by $(\mathbb{F},\tau)$, where $\mathbb{F}$ is the "public" flow of information, and $\tau$ is a random time which might not be $\mathbb{F}$-observable. This framework covers credit risk theory and life insurance. In this setting, we assume $\mathbb{F}$ being generated by a Brownian motion $W$ and consider a vulnerable claim $\xi$, whose payment's policy depends {\it{essentially}} on the occurrence of $\tau$. The hedging problems, in many directions, for this claim led to the question of studying the linear reflected-backward-stochastic differential equations (RBSDE hereafter), \begin{equation*} \begin{split} &dY_t=f(t)d(t\wedge\tau)+Z_tdW_{t\wedge{\tau}}+dM_t-dK_t,\quad Y_{\tau}=\xi,\\ & Y\geq S\quad\mbox{on}\quad \Lbrack0,\tau\Lbrack,\quad \displaystyle\int_0^{\tau}(Y_{s-}-S_{s-})dK_s=0\quad P\mbox{-a.s.}.\end{split} \end{equation*} This is the objective of this paper. For this RBSDE and without any further assumption on $\tau$ that might neglect any risk intrinsic to its stochasticity, we answer the following: a) What are the sufficient minimal conditions on the data $(f, \xi, S, \tau)$ that guarantee the existence of the solution to this RBSDE? b) How can we estimate the solution in norm using $(f, \xi, S)$? c) Is there an $\mathbb F$-RBSDE that is intimately related to the current one and how their solutions are related to each other? This latter question has practical and theoretical leitmotivs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

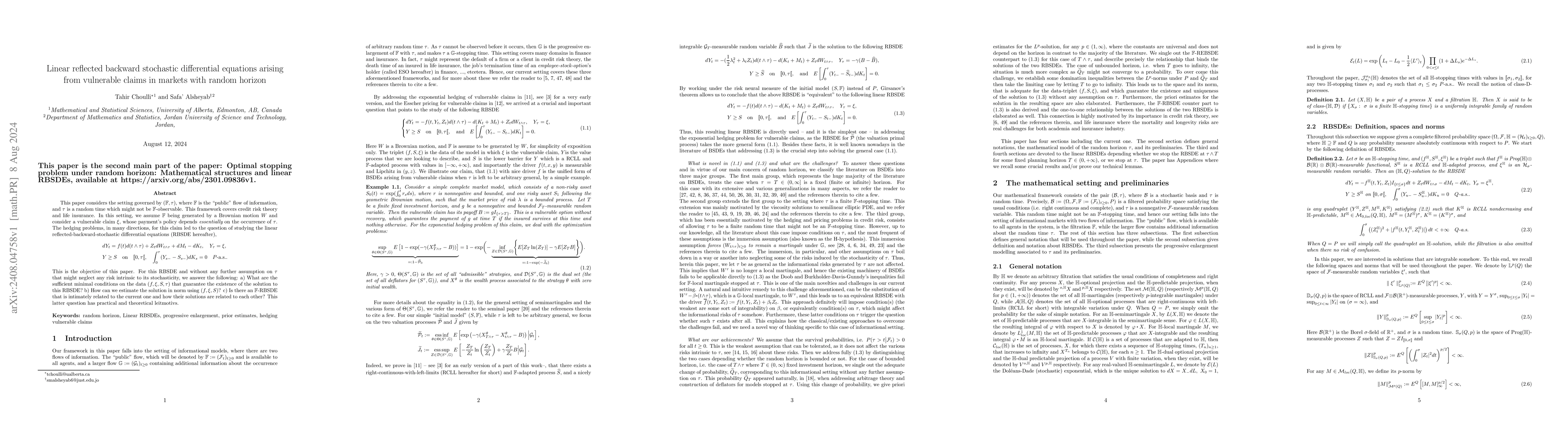

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)