Authors

Summary

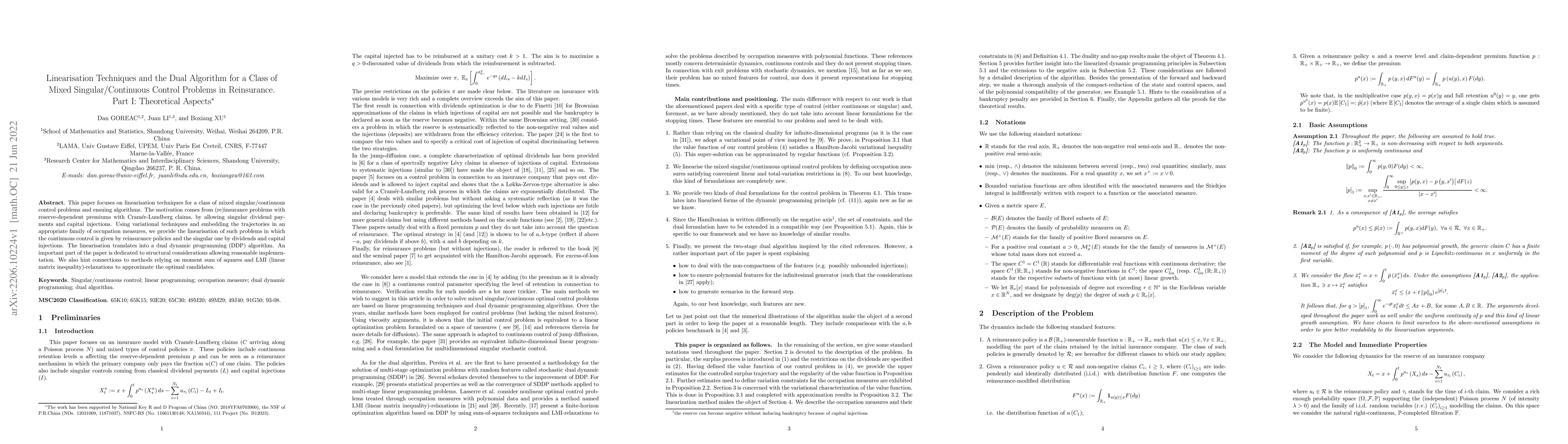

This paper focuses on linearisation techniques for a class of mixed singular/continuous control problems and ensuing algorithms. The motivation comes from (re)insurance problems with reserve-dependent premiums with Cram{\'e}r-Lundberg claims, by allowing singular dividend payments and capital injections. Using variational techniques and embedding the trajectories in an appropriate family of occupation measures, we provide the linearisation of such problems in which the continuous control is given by reinsurance policies and the singular one by dividends and capital injections. The linearisation translates into a dual dynamic programming (DDP) algorithm. An important part of the paper is dedicated to structural considerations allowing reasonable implementation. We also hint connections to methods relying on moment sum of squares and LMI (linear matrix inequality)-relaxations to approximate the optimal candidates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)