Summary

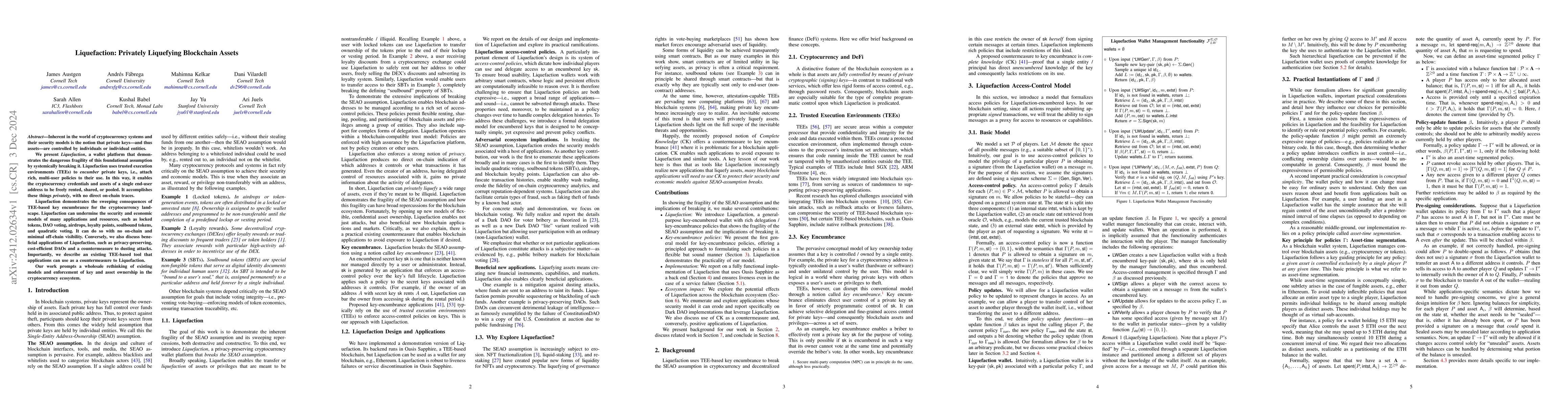

Inherent in the world of cryptocurrency systems and their security models is the notion that private keys, and thus assets, are controlled by individuals or individual entities. We present Liquefaction, a wallet platform that demonstrates the dangerous fragility of this foundational assumption by systemically breaking it. Liquefaction uses trusted execution environments (TEEs) to encumber private keys, i.e., attach rich, multi-user policies to their use. In this way, it enables the cryptocurrency credentials and assets of a single end-user address to be freely rented, shared, or pooled. It accomplishes these things privately, with no direct on-chain traces. Liquefaction demonstrates the sweeping consequences of TEE-based key encumbrance for the cryptocurrency landscape. Liquefaction can undermine the security and economic models of many applications and resources, such as locked tokens, DAO voting, airdrops, loyalty points, soulbound tokens, and quadratic voting. It can do so with no on-chain and minimal off-chain visibility. Conversely, we also discuss beneficial applications of Liquefaction, such as privacy-preserving, cost-efficient DAOs and a countermeasure to dusting attacks. Importantly, we describe an existing TEE-based tool that applications can use as a countermeasure to Liquefaction. Our work prompts a wholesale rethinking of existing models and enforcement of key and asset ownership in the cryptocurrency ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Strategyproof Mechanism for Ownership Restructuring in Privately Owned Assets

Omer Madmon, Moran Koren, Gal Danino

Tokenization of Real Estate Assets Using Blockchain

Shashank Joshi, Arhan Choudhury

No citations found for this paper.

Comments (0)