Summary

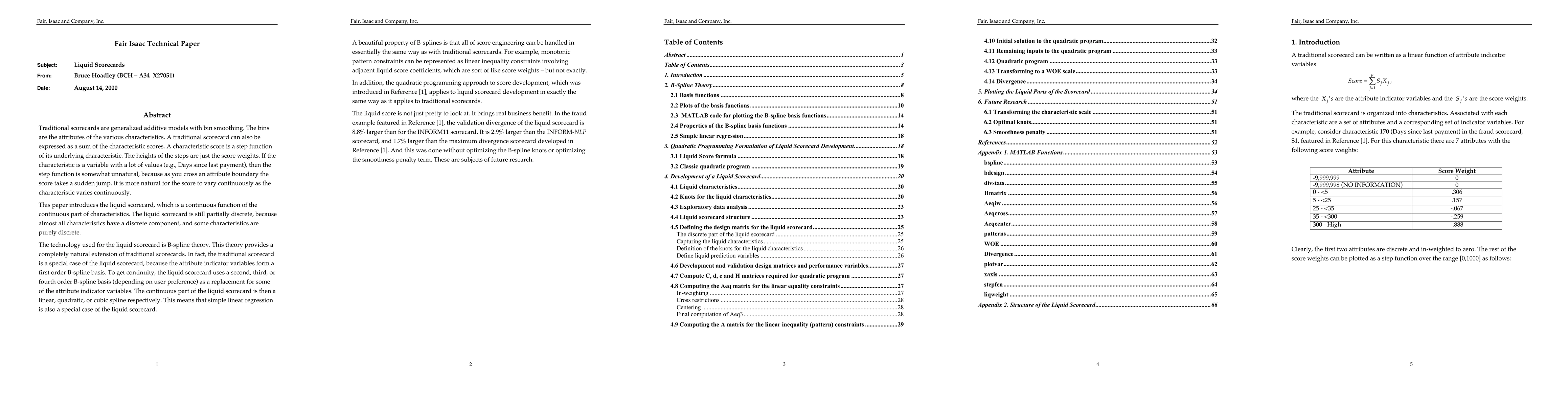

Traditional credit scorecards are generalized additive models (GAMs) with step functions as the component functions. The shapes of the step functions may be constrained in order to satisfy the PILE (Palatability, Interpretability, Legal, Explain-ability) constraints. Before 2003, FICO used Linear Programming to find the traditional scorecard that approximately maximizes divergence subject to the PILE constraints. In this paper, I introduce the Liquid Scorecard, that allows the component functions to be, at least partially, smooth curves. I use Quadratic Programming and B-Spline theory to find the Liquid Scorecard that exactly maximizes divergence subject to the PILE constraints. FICO uses aspects of this technology to develop the famous FICO Credit Score.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersScorecards for Synthetic Medical Data Evaluation and Reporting

Elena Sizikova, Jana Delfino, Aldo Badano et al.

A proposed simulation technique for population stability testing in credit risk scorecards

J. S. Allison, I. J. H. Visagie, J. du Pisanie

| Title | Authors | Year | Actions |

|---|

Comments (0)