Summary

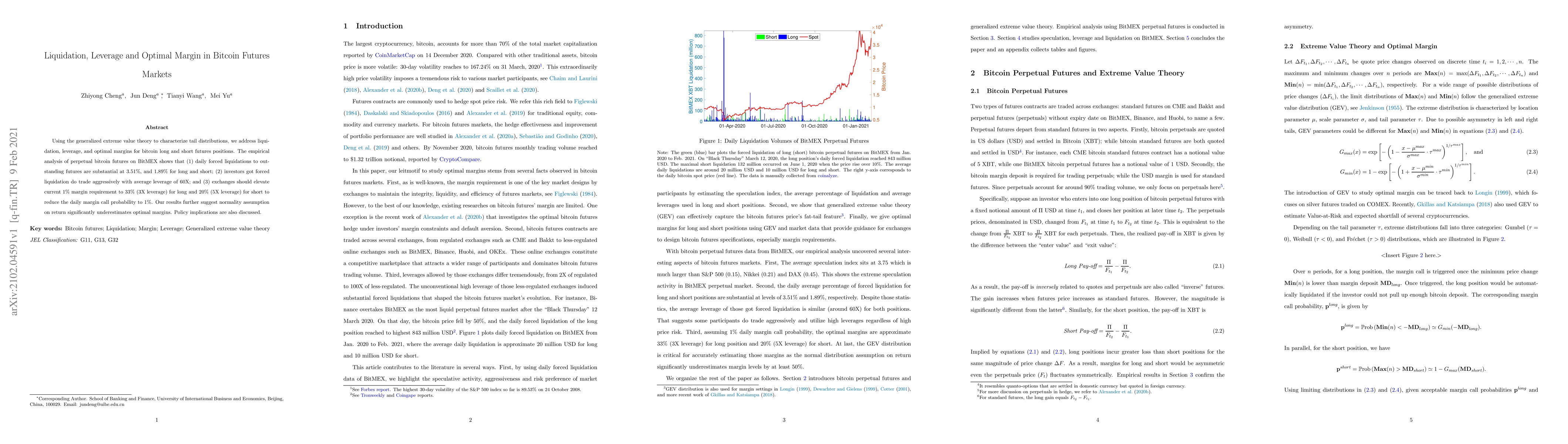

Using the generalized extreme value theory to characterize tail distributions, we address liquidation, leverage, and optimal margins for bitcoin long and short futures positions. The empirical analysis of perpetual bitcoin futures on BitMEX shows that (1) daily forced liquidations to out- standing futures are substantial at 3.51%, and 1.89% for long and short; (2) investors got forced liquidation do trade aggressively with average leverage of 60X; and (3) exchanges should elevate current 1% margin requirement to 33% (3X leverage) for long and 20% (5X leverage) for short to reduce the daily margin call probability to 1%. Our results further suggest normality assumption on return significantly underestimates optimal margins. Policy implications are also discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)