Summary

This paper investigates the application of large language models (LLMs) to financial tasks. We fine-tuned foundation models using the Open FinLLM Leaderboard as a benchmark. Building on Qwen2.5 and Deepseek-R1, we employed techniques including supervised fine-tuning (SFT), direct preference optimization (DPO), and reinforcement learning (RL) to enhance their financial capabilities. The fine-tuned models demonstrated substantial performance gains across a wide range of financial tasks. Moreover, we measured the data scaling law in the financial domain. Our work demonstrates the potential of large language models (LLMs) in financial applications.

AI Key Findings

Generated Jun 09, 2025

Methodology

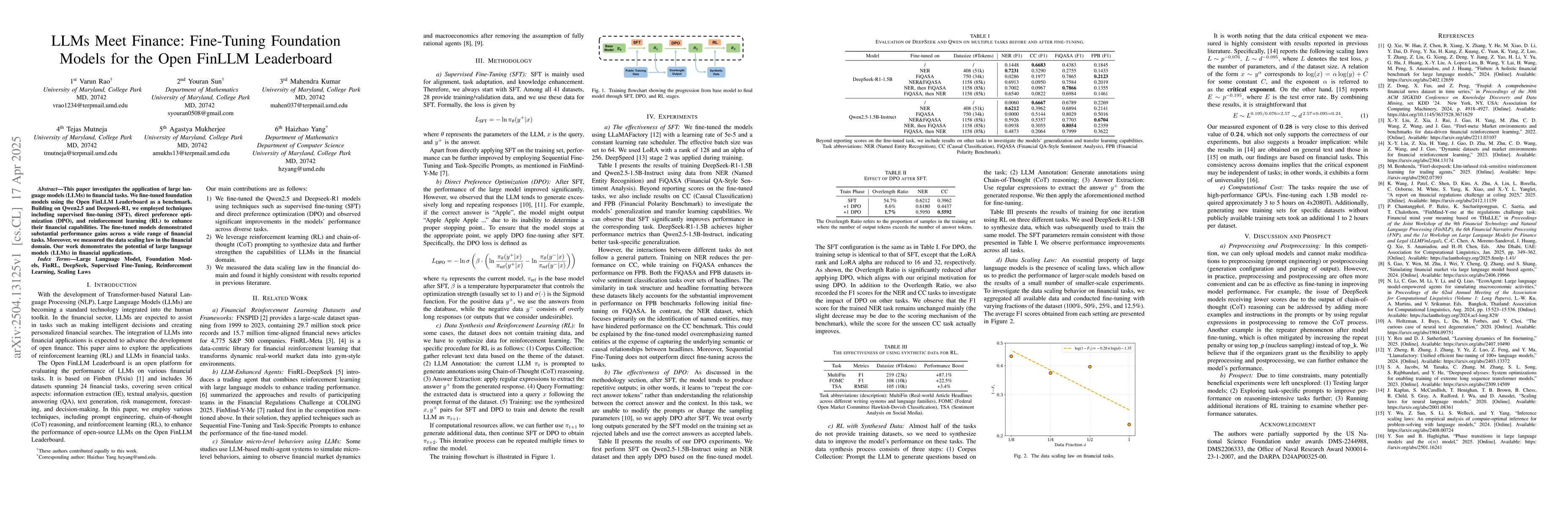

The paper employs supervised fine-tuning (SFT), direct preference optimization (DPO), and reinforcement learning (RL) techniques to enhance the performance of foundation models on the Open FinLLM Leaderboard, which includes 36 datasets spanning 24 financial tasks.

Key Results

- Fine-tuning Qwen2.5 and Deepseek-R1 models with SFT and DPO significantly improved performance across diverse financial tasks.

- Reinforcement learning (RL) and chain-of-thought (CoT) prompting strengthened LLMs' capabilities in the financial domain.

- The data scaling law in the financial domain was measured and found to be consistent with previous literature.

Significance

This research demonstrates the potential of large language models (LLMs) in financial applications, advancing the development of open finance by enhancing LLMs' performance on financial tasks.

Technical Contribution

The paper presents a comprehensive methodology for fine-tuning foundation models on financial tasks using SFT, DPO, and RL, along with data synthesis for reinforcement learning.

Novelty

The work stands out by applying LLMs to a wide range of financial tasks, measuring data scaling laws in the financial domain, and demonstrating the effectiveness of RL and CoT prompting in enhancing financial LLM capabilities.

Limitations

- The study was limited by time constraints, leaving potentially beneficial experiments unexplored.

- The competition's rules restricted modifications to preprocessing (prompt engineering) and postprocessing (output generation configuration and parsing).

Future Work

- Testing larger models and exploring task-specific prompts for improved performance on reasoning-intensive tasks.

- Running additional iterations of RL training to examine if performance saturates.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOpen FinLLM Leaderboard: Towards Financial AI Readiness

Jimin Huang, Qianqian Xie, Matt White et al.

CatMemo at the FinLLM Challenge Task: Fine-Tuning Large Language Models using Data Fusion in Financial Applications

Zhiyuan Yao, Zhiyang Deng, Yupeng Cao et al.

DISC-FinLLM: A Chinese Financial Large Language Model based on Multiple Experts Fine-tuning

Wei Chen, Xuanjing Huang, Xiang Bai et al.

'Finance Wizard' at the FinLLM Challenge Task: Financial Text Summarization

Meisin Lee, Soon Lay-Ki

No citations found for this paper.

Comments (0)