Summary

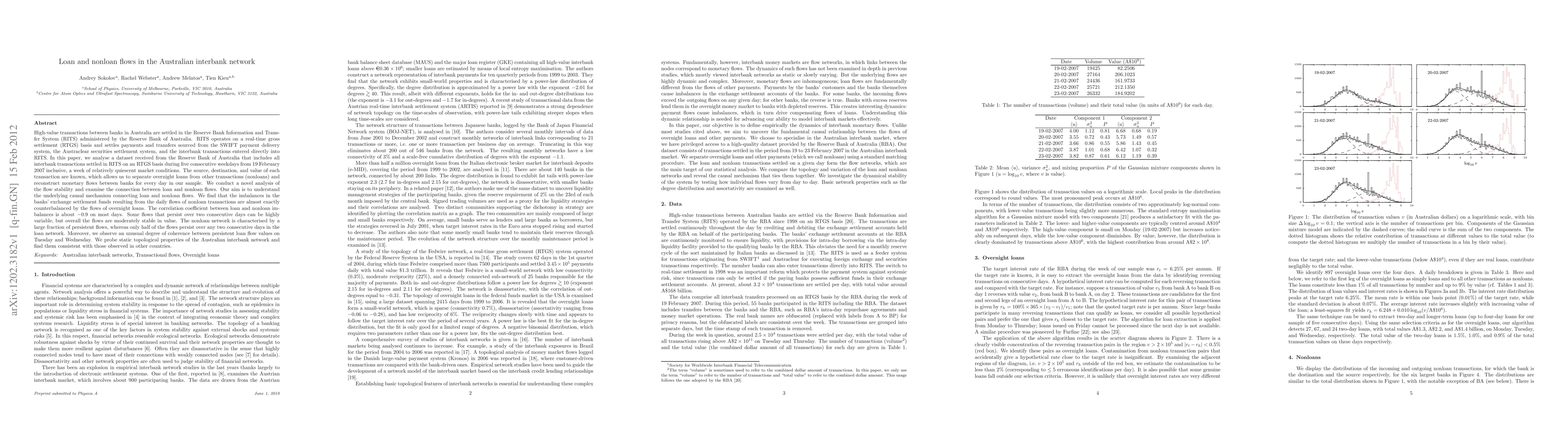

High-value transactions between Australian banks are settled in the Reserve Bank Information and Transfer System (RITS) administered by the Reserve Bank of Australia. RITS operates on a real-time gross settlement (RTGS) basis and settles payments sourced from the SWIFT, the Austraclear, and the interbank transactions entered directly into RITS. In this paper, we analyse a dataset received from the Reserve Bank of Australia that includes all interbank transactions settled in RITS on an RTGS basis during five consecutive weekdays from 19 February 2007 inclusive, a week of relatively quiescent market conditions. The source, destination, and value of each transaction are known, which allows us to separate overnight loans from other transactions (nonloans) and reconstruct monetary flows between banks for every day in our sample. We conduct a novel analysis of the flow stability and examine the connection between loan and nonloan flows. Our aim is to understand the underlying causal mechanism connecting loan and nonloan flows. We find that the imbalances in the banks' exchange settlement funds resulting from the daily flows of nonloan transactions are almost exactly counterbalanced by the flows of overnight loans. The correlation coefficient between loan and nonloan imbalances is about -0.9 on most days. Some flows that persist over two consecutive days can be highly variable, but overall the flows are moderately stable in value. The nonloan network is characterised by a large fraction of persistent flows, whereas only half of the flows persist over any two consecutive days in the loan network. Moreover, we observe an unusual degree of coherence between persistent loan flow values on Tuesday and Wednesday. We probe static topological properties of the Australian interbank network and find them consistent with those observed in other countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)