Summary

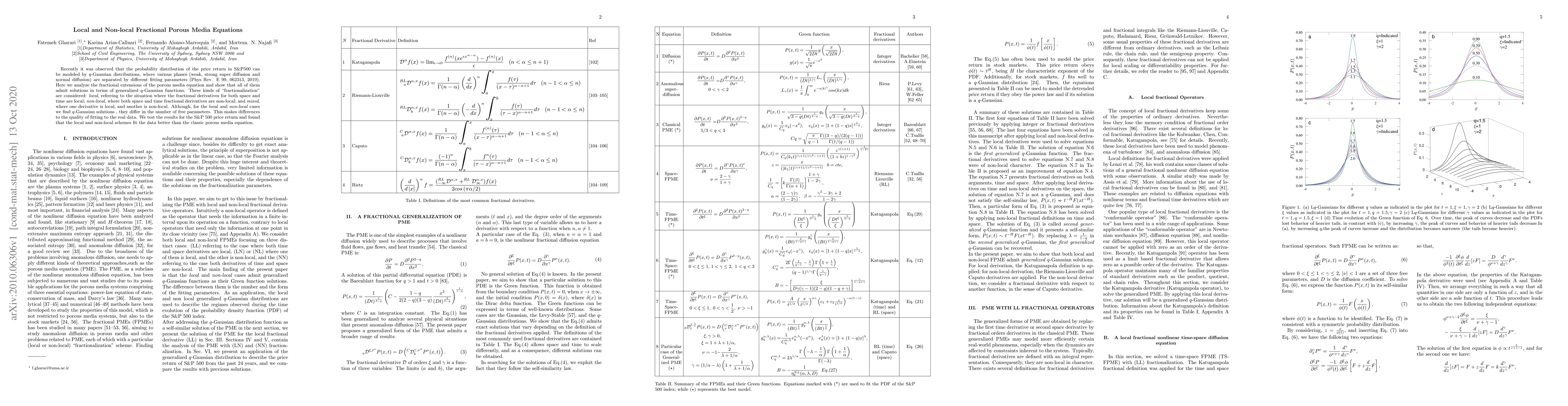

Recently it was observed that the probability distribution of the price return in S\&P500 can be modeled by $q$-Gaussian distributions, where various phases (weak, strong super diffusion and normal diffusion) are separated by different fitting parameters (Phys Rev. E 99, 062313, 2019). Here we analyze the fractional extensions of the porous media equation and show that all of them admit solutions in terms of generalized $q$-Gaussian functions. Three kinds of "fractionalization" are considered: \textit{local}, referring to the situation where the fractional derivatives for both space and time are local; \textit{non-local}, where both space and time fractional derivatives are non-local; and \textit{mixed}, where one derivative is local, and another is non-local. Although, for the \textit{local} and \textit{non-local} cases we find $q$-Gaussian solutions , they differ in the number of free parameters. This makes differences to the quality of fitting to the real data. We test the results for the S\&P 500 price return and found that the local and non-local schemes fit the data better than the classic porous media equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)