Summary

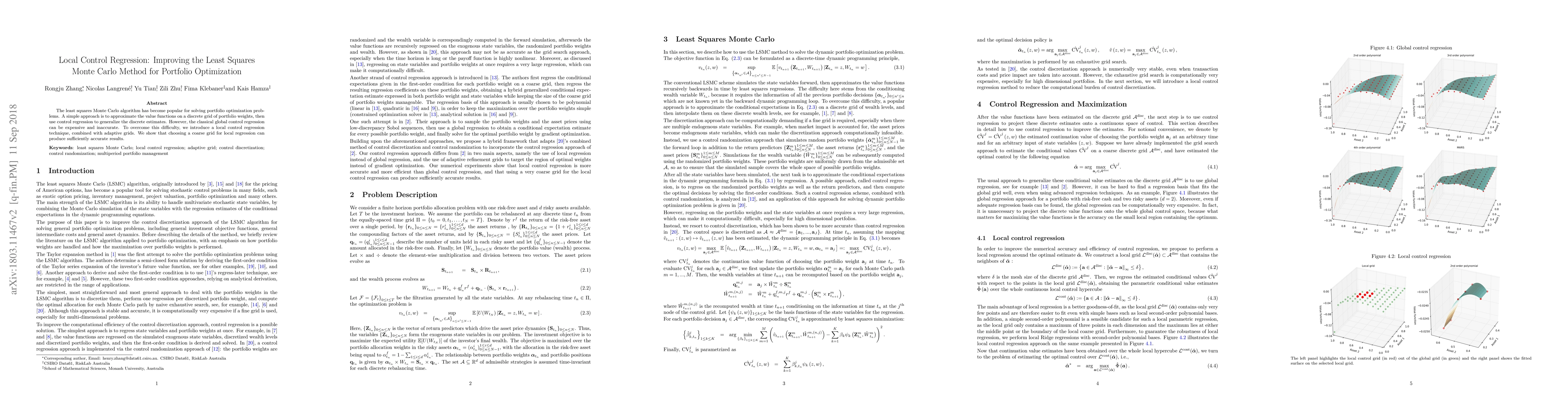

The least squares Monte Carlo algorithm has become popular for solving portfolio optimization problems. A simple approach is to approximate the value functions on a discrete grid of portfolio weights, then use control regression to generalize the discrete estimates. However, the classical global control regression can be expensive and inaccurate. To overcome this difficulty, we introduce a local control regression technique, combined with adaptive grids. We show that choosing a coarse grid for local regression can produce sufficiently accurate results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)