Summary

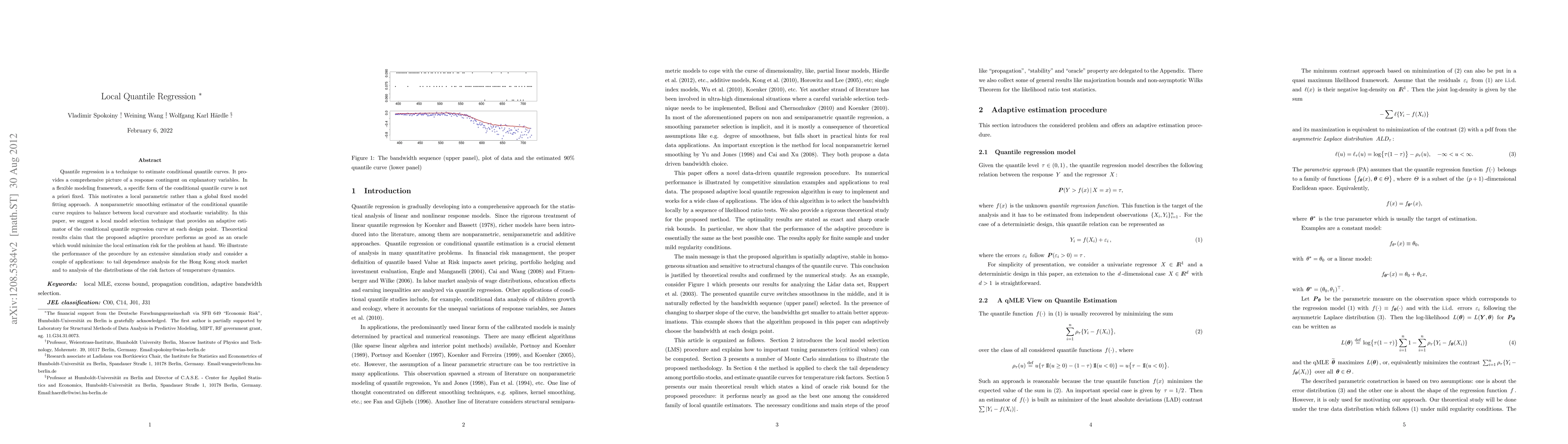

Quantile regression is a technique to estimate conditional quantile curves. It provides a comprehensive picture of a response contingent on explanatory variables. In a flexible modeling framework, a specific form of the conditional quantile curve is not a priori fixed. % Indeed, the majority of applications do not per se require specific functional forms. This motivates a local parametric rather than a global fixed model fitting approach. A nonparametric smoothing estimator of the conditional quantile curve requires to balance between local curvature and stochastic variability. In this paper, we suggest a local model selection technique that provides an adaptive estimator of the conditional quantile regression curve at each design point. Theoretical results claim that the proposed adaptive procedure performs as good as an oracle which would minimize the local estimation risk for the problem at hand. We illustrate the performance of the procedure by an extensive simulation study and consider a couple of applications: to tail dependence analysis for the Hong Kong stock market and to analysis of the distributions of the risk factors of temperature dynamics.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes a local model selection technique for adaptive estimation of the conditional quantile regression curve at each design point, balancing local curvature and stochastic variability.

Key Results

- The proposed adaptive procedure performs as well as an oracle minimizing the local estimation risk.

- Extensive simulation studies demonstrate the performance of the procedure.

- Applications to tail dependence analysis for the Hong Kong stock market and analysis of risk factors in temperature dynamics are provided.

Significance

This research is significant as it offers a flexible nonparametric approach to estimating conditional quantile curves, providing a comprehensive picture of response contingent on explanatory variables, which is crucial for various fields including finance and climate science.

Technical Contribution

The paper introduces a local model selection technique for adaptive estimation of conditional quantile regression curves, claiming theoretical performance comparable to an oracle estimator.

Novelty

The novelty lies in the local parametric rather than global fixed model fitting approach, which adapts to the data's inherent structure without imposing specific functional forms.

Limitations

- The paper does not discuss potential computational challenges associated with the adaptive procedure.

- Limited to applications in finance and climate science; generalizability to other domains is not explored.

Future Work

- Investigate computational efficiency and scalability of the proposed method for large datasets.

- Explore applications in other domains such as healthcare, engineering, and social sciences.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)