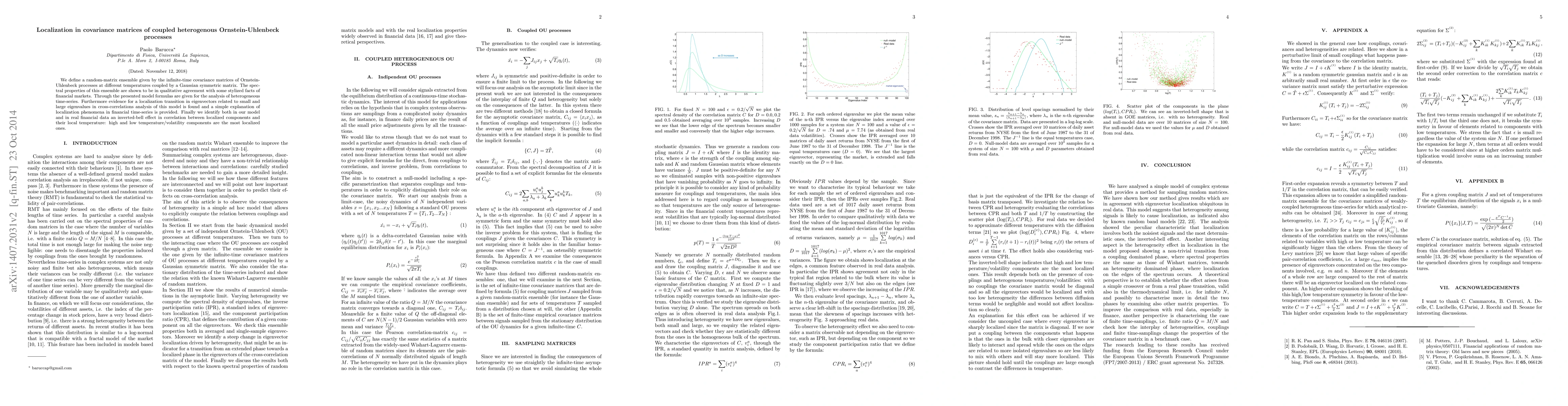

Summary

We define a random-matrix ensemble given by the infinite-time covariance matrices of Ornstein-Uhlenbeck processes at different temperatures coupled by a Gaussian symmetric matrix. The spectral properties of this ensemble are shown to be in qualitative agreement with some stylized facts of financial markets. Through the presented model formulas are given for the analysis of heterogeneous time-series. Furthermore evidence for a localization transition in eigenvectors related to small and large eigenvalues in cross-correlations analysis of this model is found and a simple explanation of localization phenomena in financial time-series is provided. Finally we identify both in our model and in real financial data an inverted-bell effect in correlation between localized components and their local temperature: high and low temperature/volatility components are the most localized ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInference for partially observed Riemannian Ornstein-Uhlenbeck diffusions of covariance matrices

Petros Dellaportas, Yvo Pokern, Mai Ngoc Bui

| Title | Authors | Year | Actions |

|---|

Comments (0)