Authors

Summary

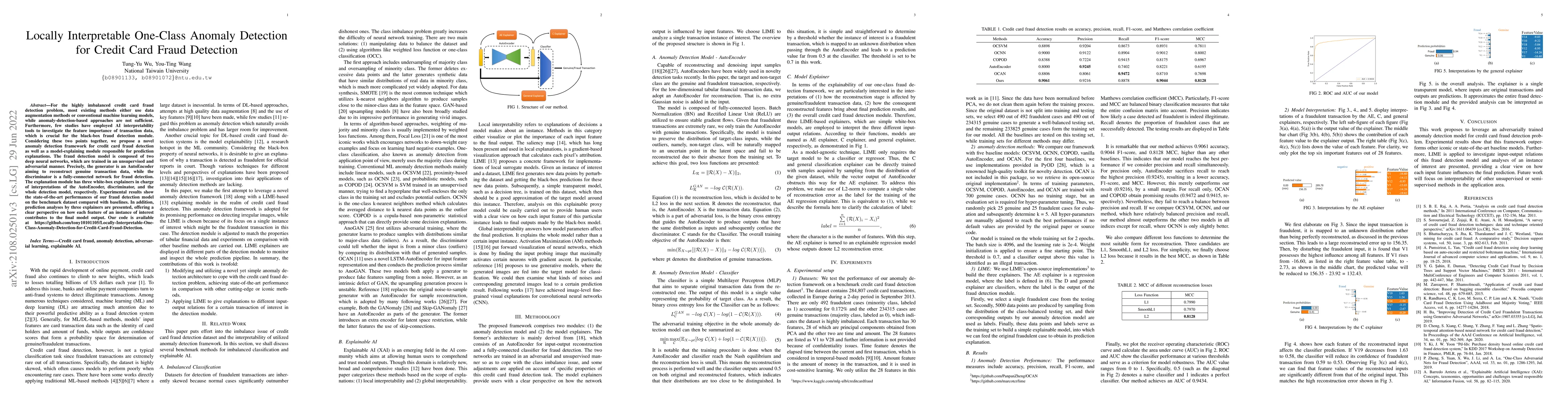

For the highly imbalanced credit card fraud detection problem, most existing methods either use data augmentation methods or conventional machine learning models, while neural network-based anomaly detection approaches are lacking. Furthermore, few studies have employed AI interpretability tools to investigate the feature importance of transaction data, which is crucial for the black-box fraud detection module. Considering these two points together, we propose a novel anomaly detection framework for credit card fraud detection as well as a model-explaining module responsible for prediction explanations. The fraud detection model is composed of two deep neural networks, which are trained in an unsupervised and adversarial manner. Precisely, the generator is an AutoEncoder aiming to reconstruct genuine transaction data, while the discriminator is a fully-connected network for fraud detection. The explanation module has three white-box explainers in charge of interpretations of the AutoEncoder, discriminator, and the whole detection model, respectively. Experimental results show the state-of-the-art performances of our fraud detection model on the benchmark dataset compared with baselines. In addition, prediction analyses by three explainers are presented, offering a clear perspective on how each feature of an instance of interest contributes to the final model output.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection with Subspace Learning-based One-Class Classification

Moncef Gabbouj, Fahad Sohrab, Juho Kanniainen et al.

Credit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

| Title | Authors | Year | Actions |

|---|

Comments (0)