Summary

In this paper we show the convergence of the long-term return $t^{-\mu}\int_0^tX(s)\d s$ for some $\mu\geq1$, where $X$ is the short-term interest rate which follows an extension of Cox-Ingersoll-Ross type model with jumps and memory, and, as an application, we also investigate the corresponding behavior of two-factor Cox-Ingersoll-Ross model with jumps and memory

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

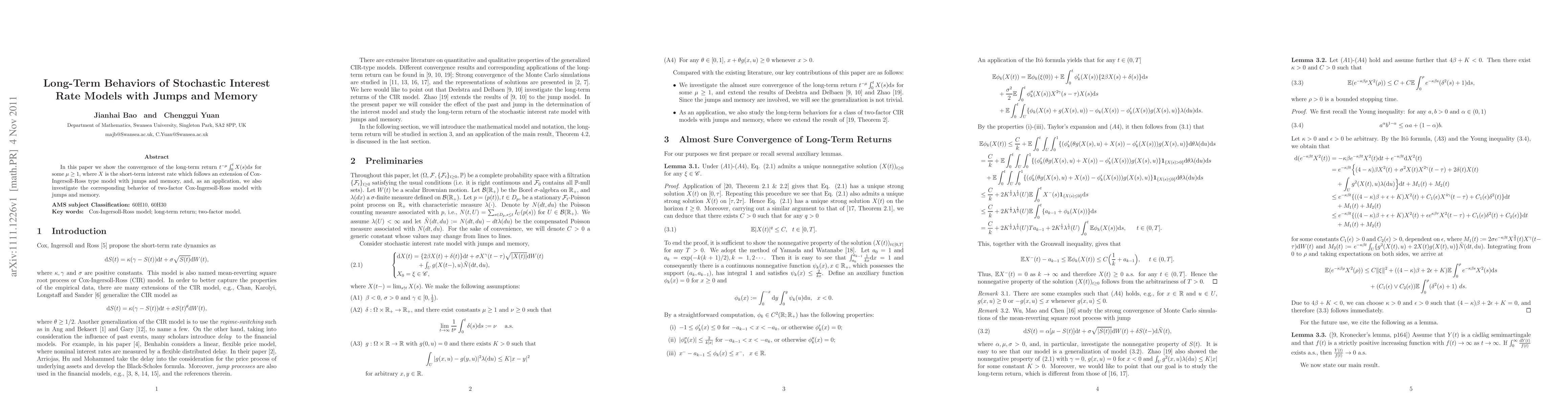

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)