Authors

Summary

This study develops a BSDE method for the long-term decomposition of pricing kernels under the G-expectation framework. We establish the existence, uniqueness, and regularity of solutions to three types of quadratic G-BSDEs: finite-horizon G-BSDEs, infinite-horizon G-BSDEs, and ergodic G-BSDEs. Moreover, we explore the Feynman--Kac formula associated with these three types of quadratic G-BSDEs. Using these results, a pricing kernel is uniquely decomposed into four components: an exponential discounting component, a transitory component, a symmetric G-martingale, and a decreasing component that captures the volatility uncertainty of the G-Brownian motion. Furthermore, these components are represented through a solution to a PDE. This study extends previous findings obtained under a single fixed probability framework to the G-expectation context.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

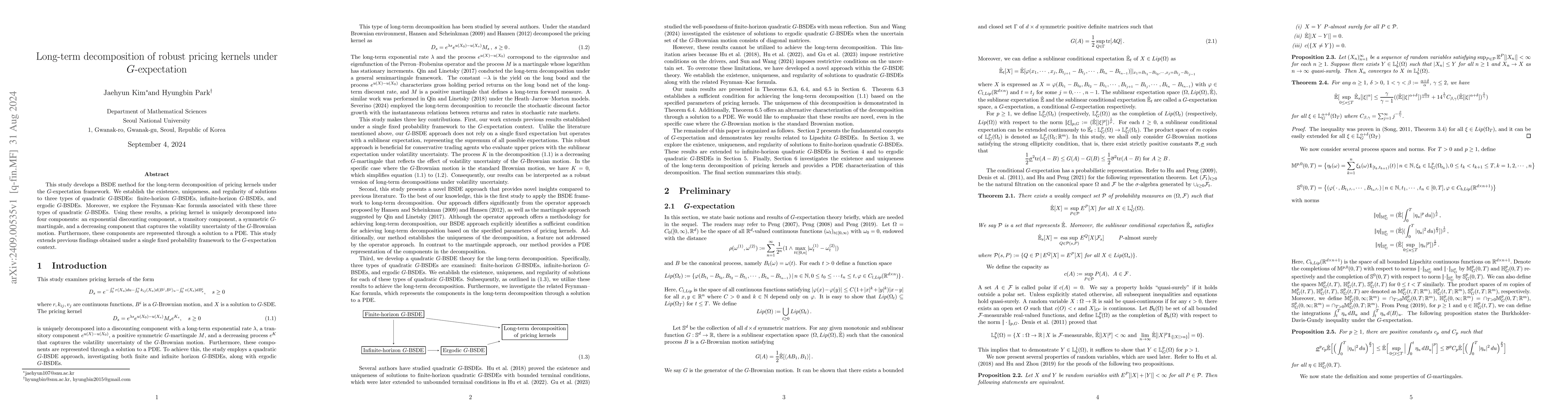

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)