Authors

Summary

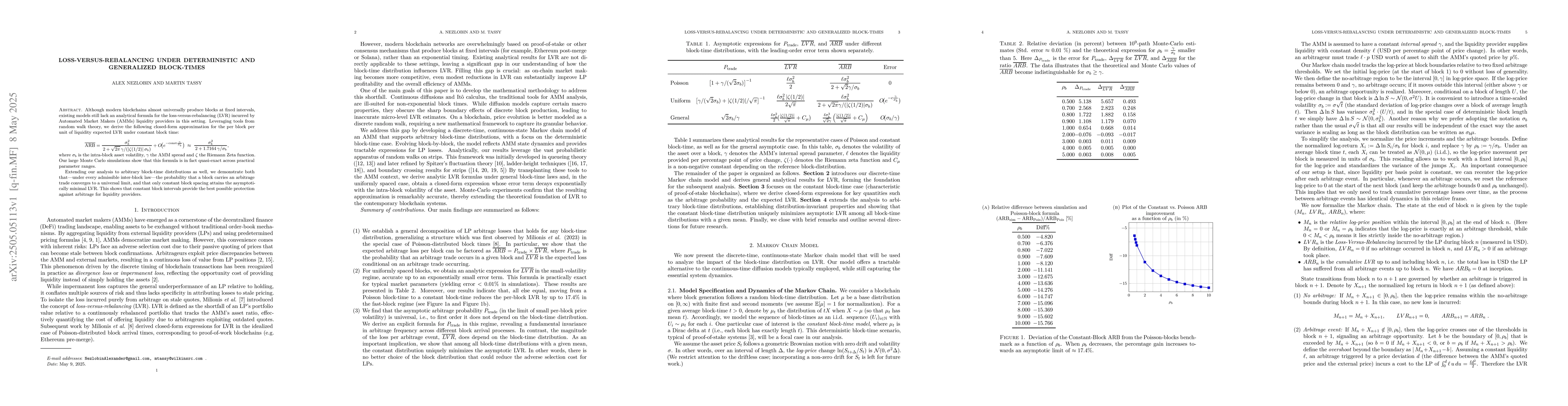

Although modern blockchains almost universally produce blocks at fixed intervals, existing models still lack an analytical formula for the loss-versus-rebalancing (LVR) incurred by Automated Market Makers (AMMs) liquidity providers in this setting. Leveraging tools from random walk theory, we derive the following closed-form approximation for the per block per unit of liquidity expected LVR under constant block time: \[ \overline{\mathrm{ARB}}= \frac{\,\sigma_b^{2}} {\,2+\sqrt{2\pi}\,\gamma/(|\zeta(1/2)|\,\sigma_b)\,}+O\!\bigl(e^{-\mathrm{const}\tfrac{\gamma}{\sigma_b}}\bigr)\;\approx\; \frac{\sigma_b^{2}}{\,2 + 1.7164\,\gamma/\sigma_b}, \] where $\sigma_b$ is the intra-block asset volatility, $\gamma$ the AMM spread and $\zeta$ the Riemann Zeta function. Our large Monte Carlo simulations show that this formula is in fact quasi-exact across practical parameter ranges. Extending our analysis to arbitrary block-time distributions as well, we demonstrate both that--under every admissible inter-block law--the probability that a block carries an arbitrage trade converges to a universal limit, and that only constant block spacing attains the asymptotically minimal LVR. This shows that constant block intervals provide the best possible protection against arbitrage for liquidity providers. \end{abstract}

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRebalancing-versus-Rebalancing: Improving the fidelity of Loss-versus-Rebalancing

Matthew Willetts, Christian Harrington

An AMM minimizing user-level extractable value and loss-versus-rebalancing

Conor McMenamin, Vanesa Daza

Impermanent loss and Loss-vs-Rebalancing II

Abe Alexander, Lars Fritz, Guillaume Lambert

Automated Market Making and Loss-Versus-Rebalancing

Tim Roughgarden, Ciamac C. Moallemi, Jason Milionis et al.

No citations found for this paper.

Comments (0)