Summary

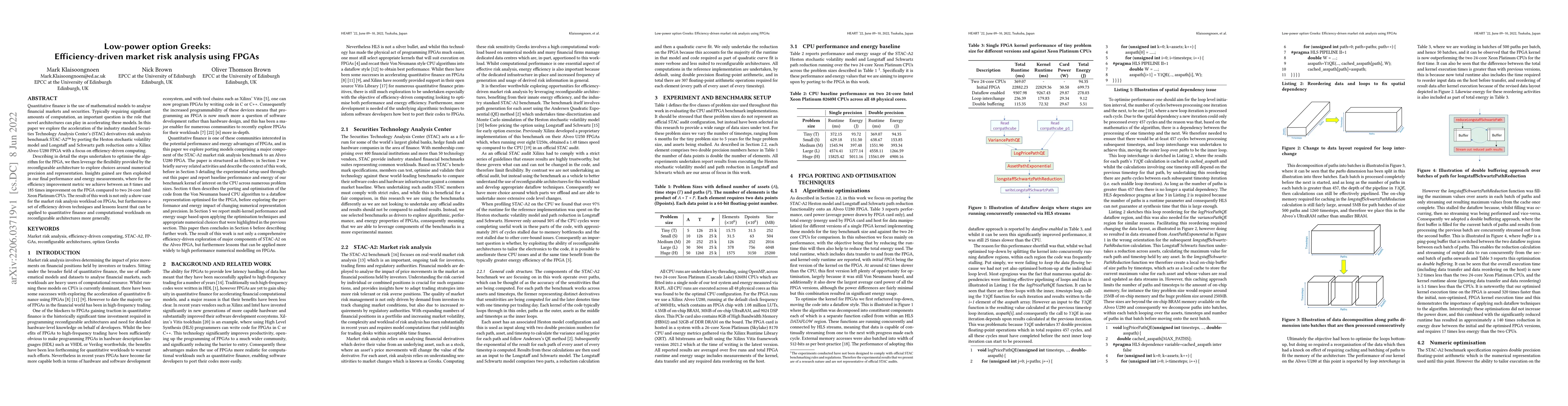

Quantitative finance is the use of mathematical models to analyse financial markets and securities. Typically requiring significant amounts of computation, an important question is the role that novel architectures can play in accelerating these models. In this paper we explore the acceleration of the industry standard Securities Technology Analysis Center's (STAC) derivatives risk analysis benchmark STAC-A2\texttrademark{} by porting the Heston stochastic volatility model and Longstaff and Schwartz path reduction onto a Xilinx Alveo U280 FPGA with a focus on efficiency-driven computing. Describing in detail the steps undertaken to optimise the algorithm for the FPGA, we then leverage the flexibility provided by the reconfigurable architecture to explore choices around numerical precision and representation. Insights gained are then exploited in our final performance and energy measurements, where for the efficiency improvement metric we achieve between an 8 times and 185 times improvement on the FPGA compared to two 24-core Intel Xeon Platinum CPUs. The result of this work is not only a show-case for the market risk analysis workload on FPGAs, but furthermore a set of efficiency driven techniques and lessons learnt that can be applied to quantitative finance and computational workloads on reconfigurable architectures more generally.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFast and energy-efficient derivatives risk analysis: Streaming option Greeks on Xilinx and Intel FPGAs

Nick Brown, Mark Klaisoongnoen, Oliver Brown

Evaluating Versal AI Engines for option price discovery in market risk analysis

Nick Brown, Mark Klaisoongnoen, Tim Dykes et al.

Quasi-Monte Carlo-Based Conditional Malliavin Method for Continuous-Time Asian Option Greeks

Chao Yu, Xiaoqun Wang

Denoised Monte Carlo for option pricing and Greeks estimation

Andrzej Daniluk, Evgeny Lakshtanov, Rafal Muchorski

| Title | Authors | Year | Actions |

|---|

Comments (0)