Summary

This paper revisits the problem of decomposing a positive semidefinite matrix as a sum of a matrix with a given rank plus a sparse matrix. An immediate application can be found in portfolio optimization, when the matrix to be decomposed is the covariance between the different assets in the portfolio. Our approach consists in representing the low-rank part of the solution as the product $MM^{T}$, where $M$ is a rectangular matrix of appropriate size, parametrized by the coefficients of a deep neural network. We then use a gradient descent algorithm to minimize an appropriate loss function over the parameters of the network. We deduce its convergence rate to a local optimum from the Lipschitz smoothness of our loss function. We show that the rate of convergence grows polynomially in the dimensions of the input, output, and the size of each of the hidden layers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

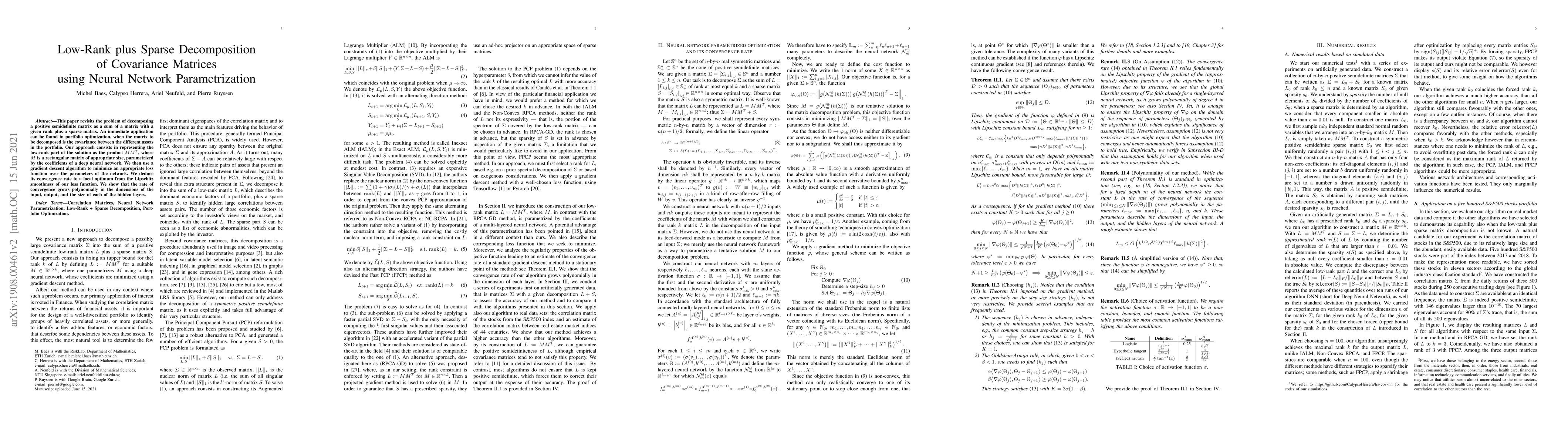

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)