Summary

We study the problem of computing data-driven personalized reserve prices in eager second price auctions without having any assumption on valuation distributions. Here, the input is a data-set that contains the submitted bids of $n$ buyers in a set of auctions and the problem is to return personalized reserve prices $\textbf r$ that maximize the revenue earned on these auctions by running eager second price auctions with reserve $\textbf r$. For this problem, which is known to be APX-hard, we present a novel LP formulation and a rounding procedure which achieves a $(1+2(\sqrt{2}-1)e^{\sqrt{2}-2})^{-1} \approx 0.684$-approximation. This improves over the $\frac{1}{2}$-approximation algorithm due to Roughgarden and Wang. We show that our analysis is tight for this rounding procedure. We also bound the integrality gap of the LP, which shows that it is impossible to design an algorithm that yields an approximation factor larger than $0.828$ with respect to this LP.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

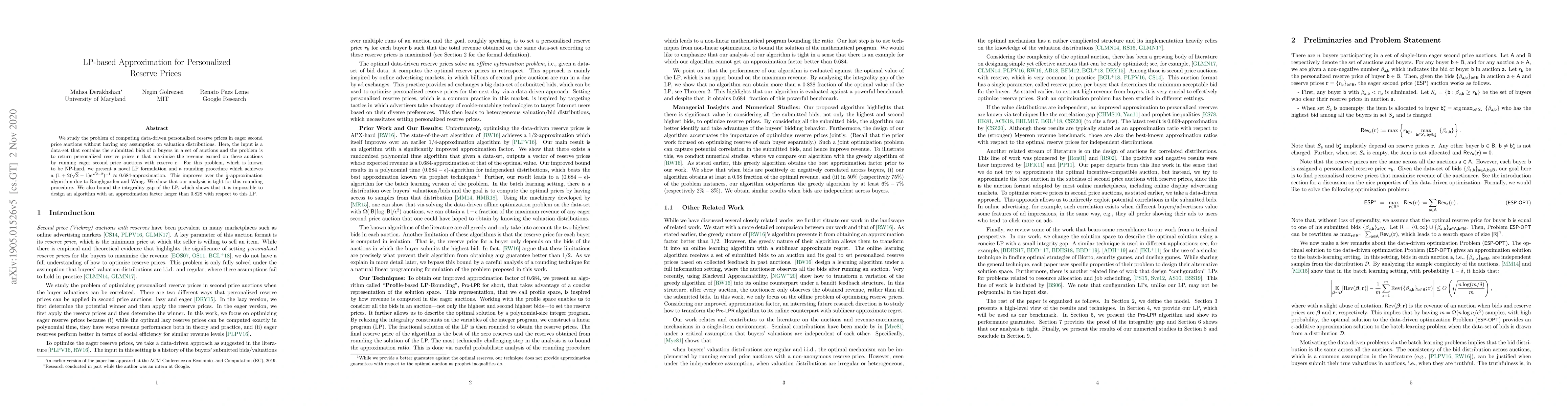

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNever Say Never: Optimal Exclusion and Reserve Prices with Expectations-Based Loss-Averse Buyers

Benjamin Balzer, Antonio Rosato

| Title | Authors | Year | Actions |

|---|

Comments (0)