Authors

Summary

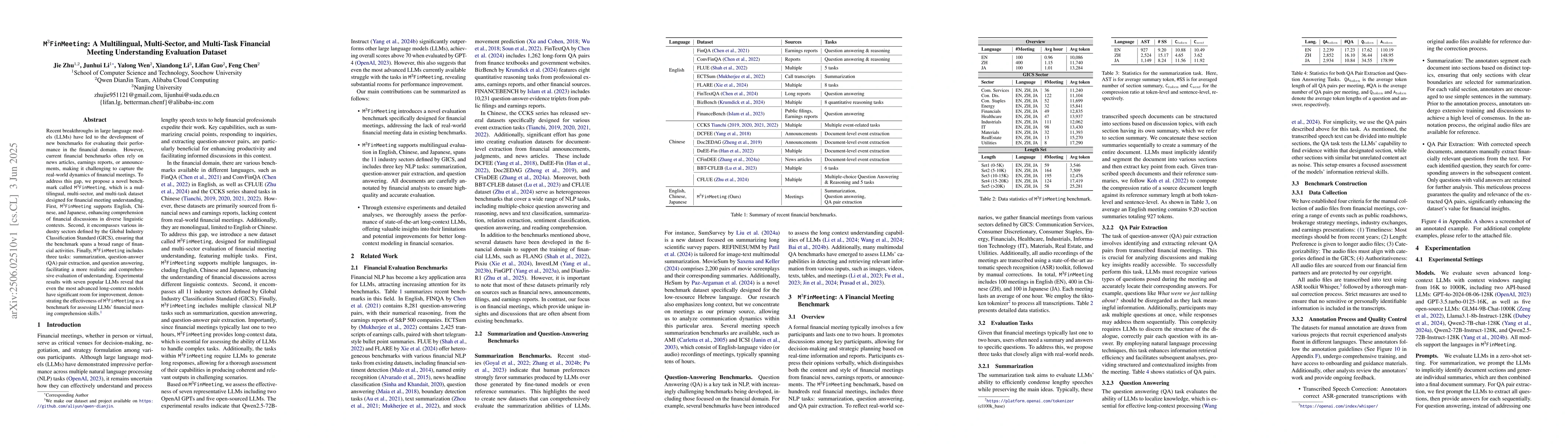

Recent breakthroughs in large language models (LLMs) have led to the development of new benchmarks for evaluating their performance in the financial domain. However, current financial benchmarks often rely on news articles, earnings reports, or announcements, making it challenging to capture the real-world dynamics of financial meetings. To address this gap, we propose a novel benchmark called $\texttt{M$^3$FinMeeting}$, which is a multilingual, multi-sector, and multi-task dataset designed for financial meeting understanding. First, $\texttt{M$^3$FinMeeting}$ supports English, Chinese, and Japanese, enhancing comprehension of financial discussions in diverse linguistic contexts. Second, it encompasses various industry sectors defined by the Global Industry Classification Standard (GICS), ensuring that the benchmark spans a broad range of financial activities. Finally, $\texttt{M$^3$FinMeeting}$ includes three tasks: summarization, question-answer (QA) pair extraction, and question answering, facilitating a more realistic and comprehensive evaluation of understanding. Experimental results with seven popular LLMs reveal that even the most advanced long-context models have significant room for improvement, demonstrating the effectiveness of $\texttt{M$^3$FinMeeting}$ as a benchmark for assessing LLMs' financial meeting comprehension skills.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes a multilingual, multi-sector, and multi-task financial meeting understanding dataset called M$^3$FinMeeting, which includes English, Chinese, and Japanese data across various industry sectors defined by GICS. It encompasses three tasks: summarization, question-answer pair extraction, and question answering.

Key Results

- M$^3$FinMeeting supports English, Chinese, and Japanese, enhancing comprehension of financial discussions in diverse linguistic contexts.

- The dataset spans a broad range of financial activities by covering various industry sectors as per the Global Industry Classification Standard (GICS).

- It includes three tasks—summarization, QA pair extraction, and question answering—for comprehensive evaluation of LLMs' financial meeting comprehension skills.

- Experiments with seven popular LLMs show significant room for improvement, demonstrating the benchmark's effectiveness.

Significance

This research is important as it addresses the gap in current financial benchmarks that primarily rely on news articles, earnings reports, or announcements, which do not capture the real-world dynamics of financial meetings. M$^3$FinMeeting enables a more realistic evaluation of large language models (LLMs) in understanding financial meetings across diverse linguistic and sectoral contexts.

Technical Contribution

The creation of M$^3$FinMeeting, a multilingual, multi-sector, and multi-task dataset for financial meeting understanding, which includes summarization, QA pair extraction, and question answering tasks.

Novelty

M$^3$FinMeeting distinguishes itself by focusing on financial meeting comprehension, incorporating multiple languages, diverse industry sectors, and various tasks, providing a more comprehensive benchmark for evaluating LLMs in the financial domain.

Limitations

- The dataset is limited to English, Chinese, and Japanese languages.

- It may not cover all possible financial meeting scenarios or nuances across various sectors.

Future Work

- Expand the dataset to include more languages and a wider range of financial meeting scenarios.

- Investigate the performance of LLMs on other financial NLP tasks using M$^3$FinMeeting as a baseline.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMULTI3NLU++: A Multilingual, Multi-Intent, Multi-Domain Dataset for Natural Language Understanding in Task-Oriented Dialogue

Anna Korhonen, Ivan Vulić, Alexandra Birch et al.

M$^3$IT: A Large-Scale Dataset towards Multi-Modal Multilingual Instruction Tuning

Qi Liu, Lei Li, Jingjing Xu et al.

$M^3EL$: A Multi-task Multi-topic Dataset for Multi-modal Entity Linking

Fang Wang, Yi Liang, Tianwei Yan et al.

Multi3WOZ: A Multilingual, Multi-Domain, Multi-Parallel Dataset for Training and Evaluating Culturally Adapted Task-Oriented Dialog Systems

Han Zhou, Anna Korhonen, Ivan Vulić et al.

No citations found for this paper.

Comments (0)