Summary

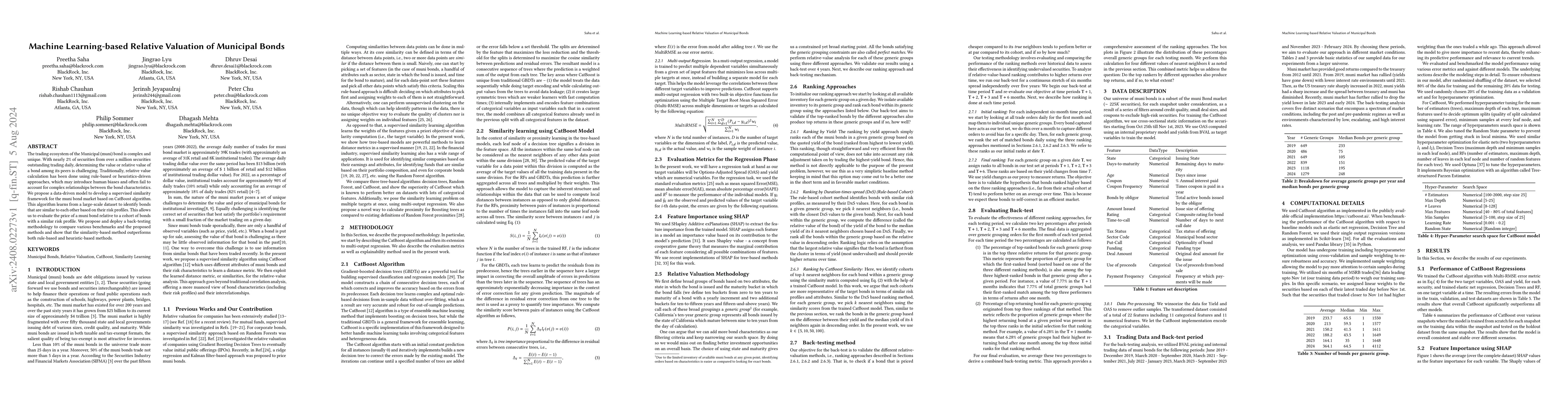

The trading ecosystem of the Municipal (muni) bond is complex and unique. With nearly 2\% of securities from over a million securities outstanding trading daily, determining the value or relative value of a bond among its peers is challenging. Traditionally, relative value calculation has been done using rule-based or heuristics-driven approaches, which may introduce human biases and often fail to account for complex relationships between the bond characteristics. We propose a data-driven model to develop a supervised similarity framework for the muni bond market based on CatBoost algorithm. This algorithm learns from a large-scale dataset to identify bonds that are similar to each other based on their risk profiles. This allows us to evaluate the price of a muni bond relative to a cohort of bonds with a similar risk profile. We propose and deploy a back-testing methodology to compare various benchmarks and the proposed methods and show that the similarity-based method outperforms both rule-based and heuristic-based methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Impact of Implicit Government Guarantee on Credit Rating of Municipal Investment Bonds

Yan Zhang, Lin Chen, Yixiang Tian

The financial value of the within-government political network: Evidence from Chinese municipal corporate bonds

Lei Lu, Jaehyuk Choi, Sungbin Sohn et al.

Pricing Catastrophe Bonds -- A Probabilistic Machine Learning Approach

Xiaowei Chen, Hong Li, Rui Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)