Summary

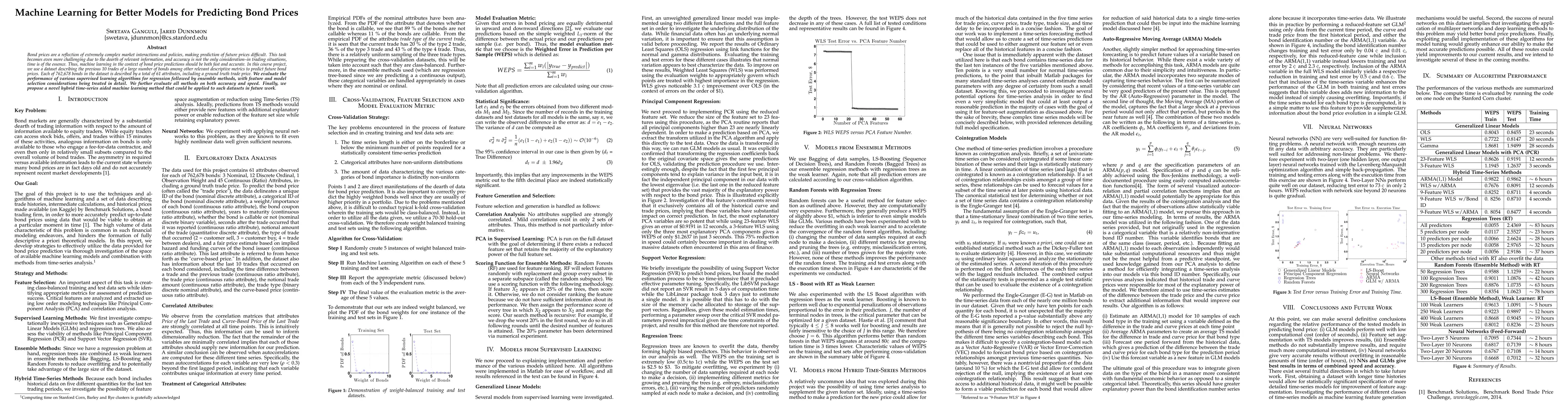

Bond prices are a reflection of extremely complex market interactions and policies, making prediction of future prices difficult. This task becomes even more challenging due to the dearth of relevant information, and accuracy is not the only consideration--in trading situations, time is of the essence. Thus, machine learning in the context of bond price predictions should be both fast and accurate. In this course project, we use a dataset describing the previous 10 trades of a large number of bonds among other relevant descriptive metrics to predict future bond prices. Each of 762,678 bonds in the dataset is described by a total of 61 attributes, including a ground truth trade price. We evaluate the performance of various supervised learning algorithms for regression followed by ensemble methods, with feature and model selection considerations being treated in detail. We further evaluate all methods on both accuracy and speed. Finally, we propose a novel hybrid time-series aided machine learning method that could be applied to such datasets in future work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Listing Prices In Dynamic Short Term Rental Markets Using Machine Learning Models

Sam Chapman, Seifey Mohammad, Kimberly Villegas

Predicting House Rental Prices in Ghana Using Machine Learning

Philip Adzanoukpe

Predicting Agricultural Commodities Prices with Machine Learning: A Review of Current Research

Quang Tran, Thanh Nguyen Ngoc, Arthur Tang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)