Summary

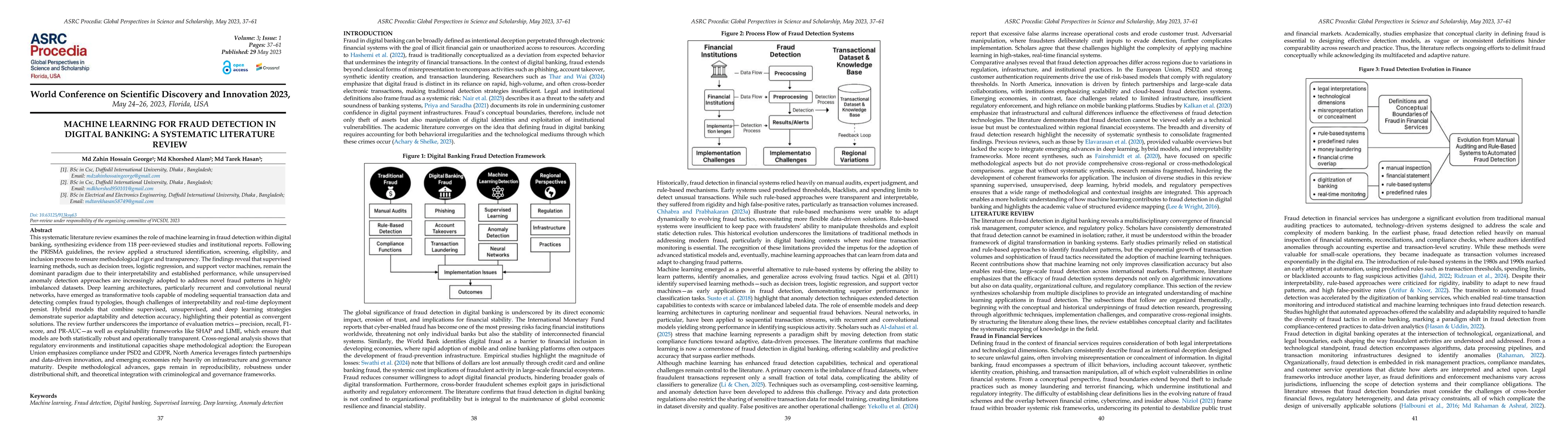

This systematic literature review examines the role of machine learning in fraud detection within digital banking, synthesizing evidence from 118 peer-reviewed studies and institutional reports. Following the PRISMA guidelines, the review applied a structured identification, screening, eligibility, and inclusion process to ensure methodological rigor and transparency. The findings reveal that supervised learning methods, such as decision trees, logistic regression, and support vector machines, remain the dominant paradigm due to their interpretability and established performance, while unsupervised anomaly detection approaches are increasingly adopted to address novel fraud patterns in highly imbalanced datasets. Deep learning architectures, particularly recurrent and convolutional neural networks, have emerged as transformative tools capable of modeling sequential transaction data and detecting complex fraud typologies, though challenges of interpretability and real-time deployment persist. Hybrid models that combine supervised, unsupervised, and deep learning strategies demonstrate superior adaptability and detection accuracy, highlighting their potential as convergent solutions.

AI Key Findings

Generated Oct 11, 2025

Methodology

The study followed PRISMA guidelines, conducting a systematic literature review of 118 peer-reviewed studies and institutional reports through structured identification, screening, eligibility, and inclusion processes.

Key Results

- Supervised learning methods like decision trees, logistic regression, and SVMs dominate fraud detection due to their interpretability and established performance.

- Unsupervised anomaly detection and deep learning (RNNs, CNNs) are increasingly adopted to address novel fraud patterns and complex transaction sequences.

- Hybrid models combining supervised, unsupervised, and deep learning strategies show superior adaptability and detection accuracy in real-time systems.

Significance

This research provides a comprehensive synthesis of machine learning applications in digital banking fraud detection, highlighting critical technical, operational, and regulatory considerations for developing effective and compliant fraud detection systems.

Technical Contribution

Establishes a structured taxonomy of fraud detection methods, evaluation metrics, and deployment strategies across different regulatory and operational contexts in digital banking.

Novelty

Provides the first systematic synthesis of global fraud detection research, integrating technical, regulatory, and operational perspectives across multiple regions and datasets.

Limitations

- Evaluation metrics often lack standardized benchmarks across different fraud detection contexts

- Private datasets and opaque feature pipelines limit reproducibility and generalizability of findings

Future Work

- Develop cross-regional benchmarking frameworks for fraud detection models

- Enhance explainability tools with standardized tests for faithfulness and stability

- Investigate robustness to adversarial attacks and distributional shifts in real-world settings

Paper Details

PDF Preview

Similar Papers

Found 5 papersMachine Learning in Digital Forensics: A Systematic Literature Review

Ali Dehghantanha, Tahereh Nayerifard, Haleh Amintoosi et al.

AI-based Identity Fraud Detection: A Systematic Review

Bo Liu, Asif Q. Gill, Chuo Jun Zhang et al.

Year-over-Year Developments in Financial Fraud Detection via Deep Learning: A Systematic Literature Review

Yixin Xu, Chuqing Zhao, Yisong Chen et al.

Assessing the influence of cybersecurity threats and risks on the adoption and growth of digital banking: a systematic literature review

Md. Waliullah, Md Zahin Hossain George, Md Tarek Hasan et al.

Combining Machine Learning and Ontology: A Systematic Literature Review

Sarah Ghidalia, Ouassila Labbani Narsis, Aurélie Bertaux et al.

Comments (0)