Authors

Summary

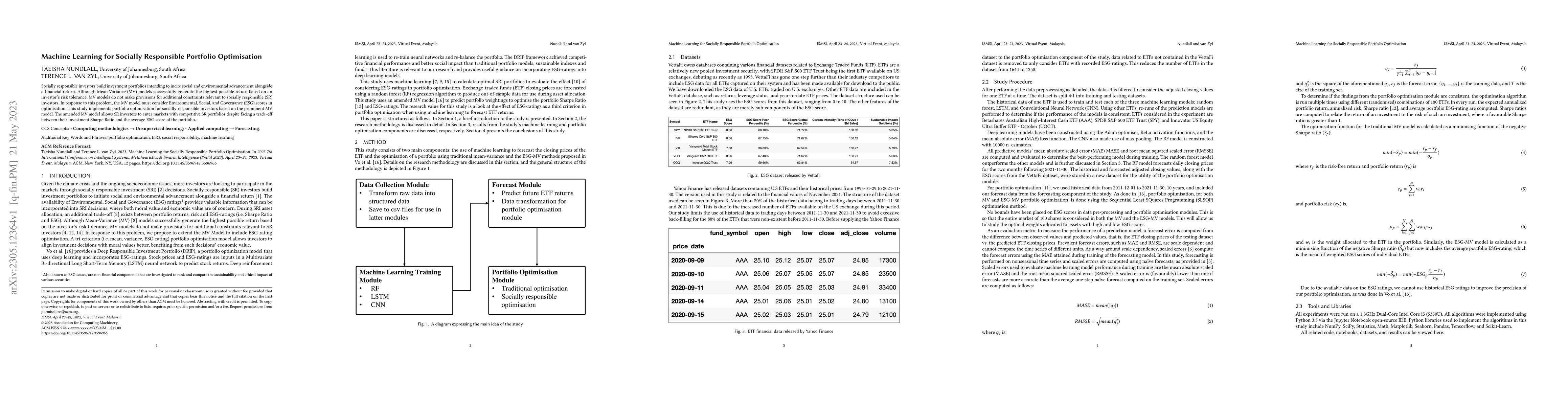

Socially responsible investors build investment portfolios intending to incite social and environmental advancement alongside a financial return. Although Mean-Variance (MV) models successfully generate the highest possible return based on an investor's risk tolerance, MV models do not make provisions for additional constraints relevant to socially responsible (SR) investors. In response to this problem, the MV model must consider Environmental, Social, and Governance (ESG) scores in optimisation. Based on the prominent MV model, this study implements portfolio optimisation for socially responsible investors. The amended MV model allows SR investors to enter markets with competitive SR portfolios despite facing a trade-off between their investment Sharpe Ratio and the average ESG score of the portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausal Learning for Socially Responsible AI

Lu Cheng, Huan Liu, Paras Sheth et al.

Causal Feature Selection for Responsible Machine Learning

Raha Moraffah, Huan Liu, Paras Sheth et al.

Deep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

No citations found for this paper.

Comments (0)