Summary

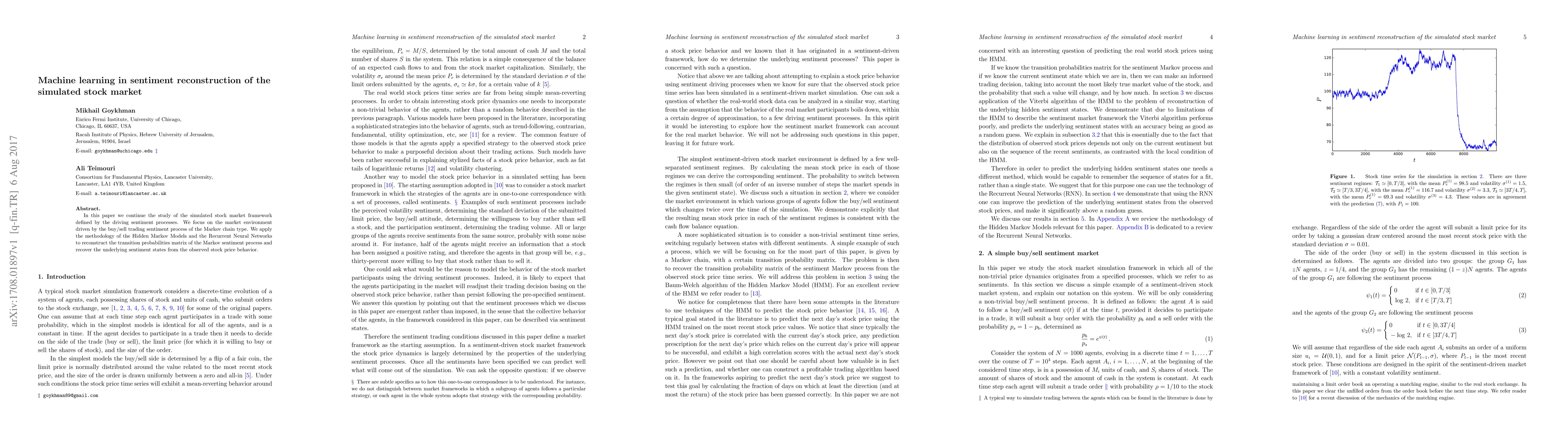

In this paper we continue the study of the simulated stock market framework defined by the driving sentiment processes. We focus on the market environment driven by the buy/sell trading sentiment process of the Markov chain type. We apply the methodology of the Hidden Markov Models and the Recurrent Neural Networks to reconstruct the transition probabilities matrix of the Markov sentiment process and recover the underlying sentiment states from the observed stock price behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGRUvader: Sentiment-Informed Stock Market Prediction

Bayode Ogunleye, Olamilekan Shobayo, Akhila Mamillapalli et al.

BERTopic-Driven Stock Market Predictions: Unraveling Sentiment Insights

Enmin Zhu, Jerome Yen

| Title | Authors | Year | Actions |

|---|

Comments (0)