Authors

Summary

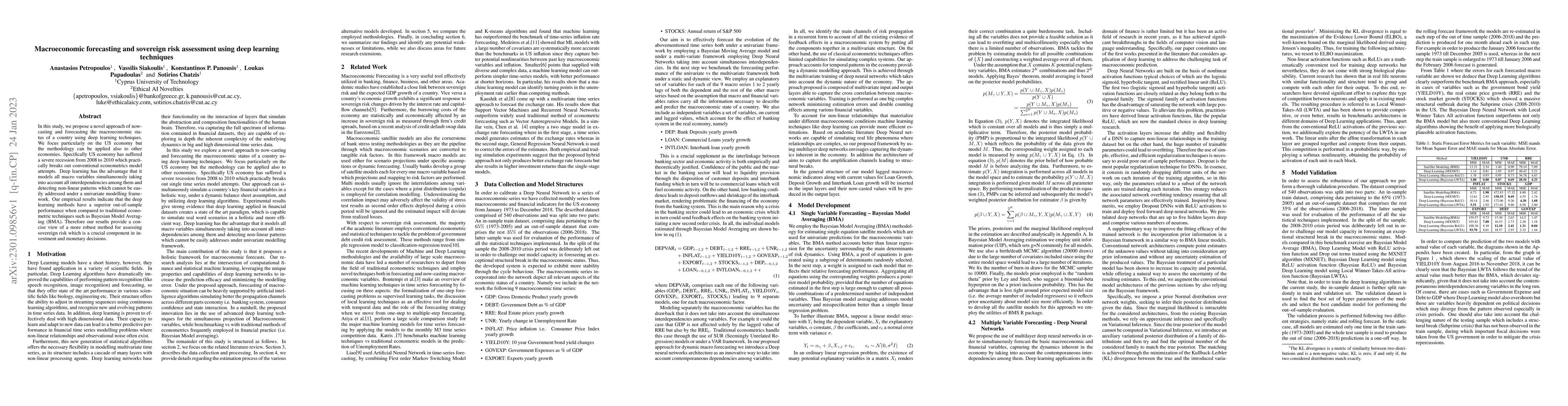

In this study, we propose a novel approach of nowcasting and forecasting the macroeconomic status of a country using deep learning techniques. We focus particularly on the US economy but the methodology can be applied also to other economies. Specifically US economy has suffered a severe recession from 2008 to 2010 which practically breaks out conventional econometrics model attempts. Deep learning has the advantage that it models all macro variables simultaneously taking into account all interdependencies among them and detecting non-linear patterns which cannot be easily addressed under a univariate modelling framework. Our empirical results indicate that the deep learning methods have a superior out-of-sample performance when compared to traditional econometric techniques such as Bayesian Model Averaging (BMA). Therefore our results provide a concise view of a more robust method for assessing sovereign risk which is a crucial component in investment and monetary decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)