Authors

Summary

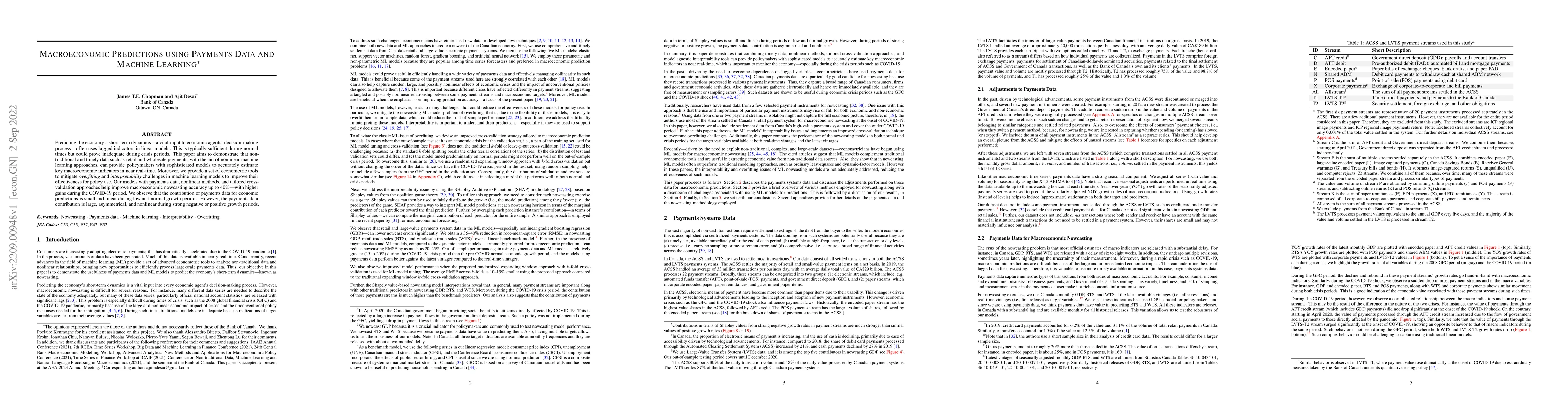

Predicting the economy's short-term dynamics -- a vital input to economic agents' decision-making process -- often uses lagged indicators in linear models. This is typically sufficient during normal times but could prove inadequate during crisis periods. This paper aims to demonstrate that non-traditional and timely data such as retail and wholesale payments, with the aid of nonlinear machine learning approaches, can provide policymakers with sophisticated models to accurately estimate key macroeconomic indicators in near real-time. Moreover, we provide a set of econometric tools to mitigate overfitting and interpretability challenges in machine learning models to improve their effectiveness for policy use. Our models with payments data, nonlinear methods, and tailored cross-validation approaches help improve macroeconomic nowcasting accuracy up to 40\% -- with higher gains during the COVID-19 period. We observe that the contribution of payments data for economic predictions is small and linear during low and normal growth periods. However, the payments data contribution is large, asymmetrical, and nonlinear during strong negative or positive growth periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExplaining Exchange Rate Forecasts with Macroeconomic Fundamentals Using Interpretive Machine Learning

Mucahit Cevik, Davood Pirayesh Neghab, M. I. M. Wahab

| Title | Authors | Year | Actions |

|---|

Comments (0)