Summary

Typically, point forecasting methods are compared and assessed by means of an error measure or scoring function, such as the absolute error or the squared error. The individual scores are then averaged over forecast cases, to result in a summary measure of the predictive performance, such as the mean absolute error or the (root) mean squared error. I demonstrate that this common practice can lead to grossly misguided inferences, unless the scoring function and the forecasting task are carefully matched. Effective point forecasting requires that the scoring function be specified ex ante, or that the forecaster receives a directive in the form of a statistical functional, such as the mean or a quantile of the predictive distribution. If the scoring function is specified ex ante, the forecaster can issue the optimal point forecast, namely, the Bayes rule. If the forecaster receives a directive in the form of a functional, it is critical that the scoring function be consistent for it, in the sense that the expected score is minimized when following the directive. A functional is elicitable if there exists a scoring function that is strictly consistent for it. Expectations, ratios of expectations and quantiles are elicitable. For example, a scoring function is consistent for the mean functional if and only if it is a Bregman function. It is consistent for a quantile if and only if it is generalized piecewise linear. Similar characterizations apply to ratios of expectations and to expectiles. Weighted scoring functions are consistent for functionals that adapt to the weighting in peculiar ways. Not all functionals are elicitable; for instance, conditional value-at-risk is not, despite its popularity in quantitative finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

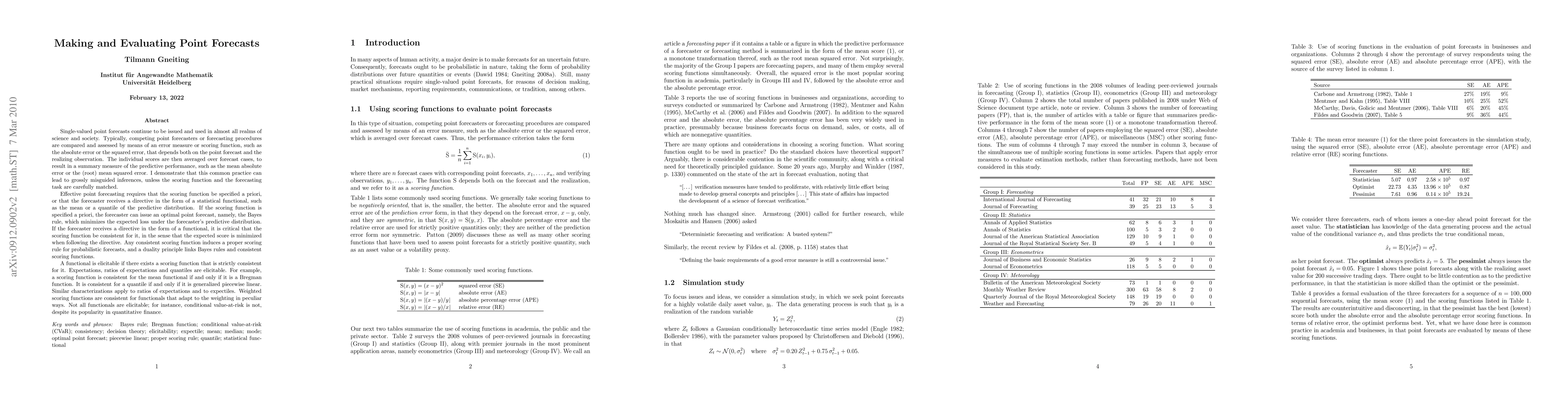

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Framework for Evaluating PM2.5 Forecasts from the Perspective of Individual Decision Making

Tamara Broderick, David R. Burt, Renato Berlinghieri et al.

Evaluating Forecasts with scoringutils in R

Anne Cori, Sebastian Funk, Sam Abbott et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)