Summary

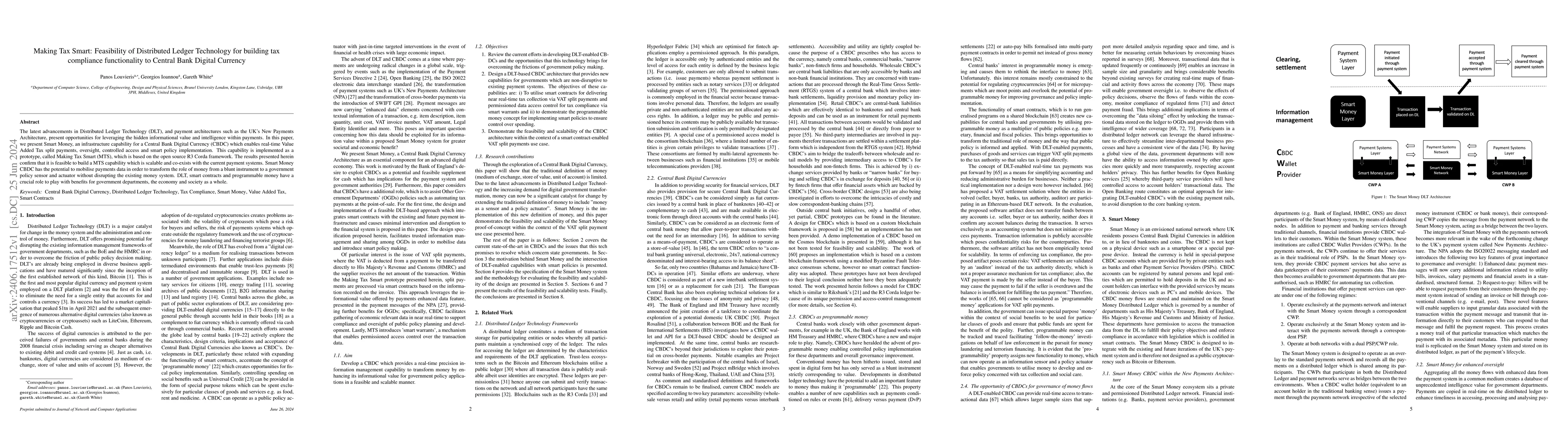

The latest advancements in Distributed Ledger Technology (DLT), and payment architectures such as the UK's New Payments Architecture, present opportunities for leveraging the hidden informational value and intelligence within payments. In this paper, we present Smart Money, an infrastructure capability for a Central Bank Digital Currency (CBDC) which enables real-time Value Added Tax split payments, oversight, controlled access and smart policy implementation. This capability is implemented as a prototype, called Making Tax Smart (MTS), which is based on the open source R3 Corda framework. The results presented herein confirm that it is feasible to build a MTS capability which is scalable and co-exists with the current payment systems. Smart Money CBDC has the potential to mobilise payments data in order to transform the role of money from a blunt instrument to a government policy sensor and actuator without disrupting the existing money system. DLT, smart contracts and programmable money have a crucial role to play with benefits for government departments, the economy and society as a whole.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)