Summary

In this paper we develop a stochastic analysis for marked binomial processes, that can be viewed as the discrete analogues of marked Poisson processes. The starting point is the statement of a chaotic expansion for square-integrable (marked binomial) functionals, prior to the elaboration of a Markov-Malliavin structure within this framework. We take advantage of the new formalism to deal with two main applications. First, we revisit the Chen-Stein method for the (compound) Poisson approximation which we perform in the paradigm of the built Markov-Malliavin structure, before studying in the second one the problem of portfolio optimisation in the trinomial model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

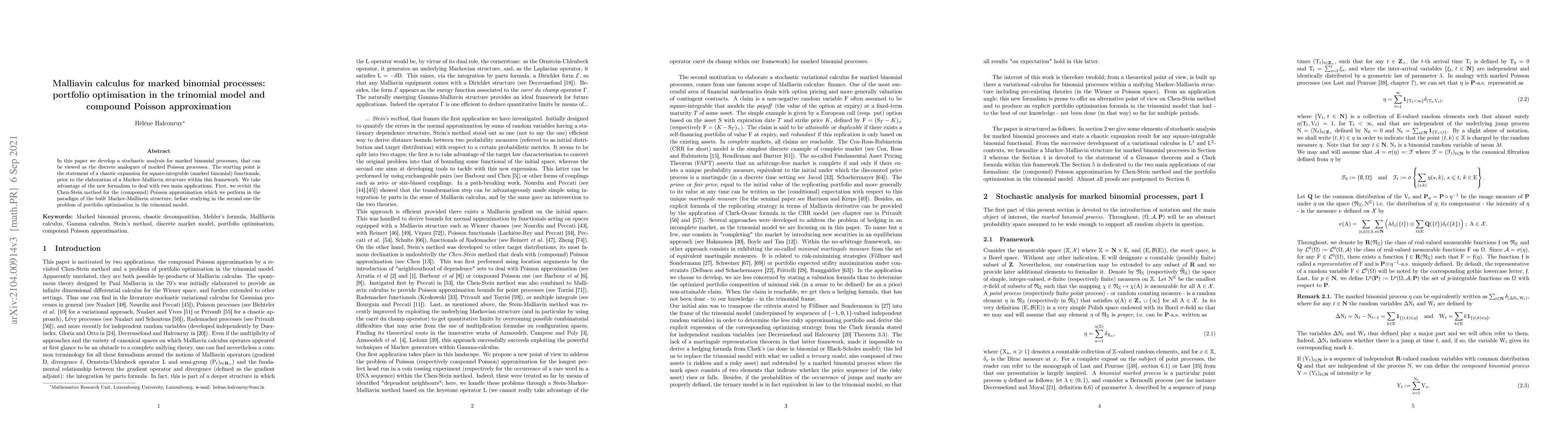

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)