Authors

Summary

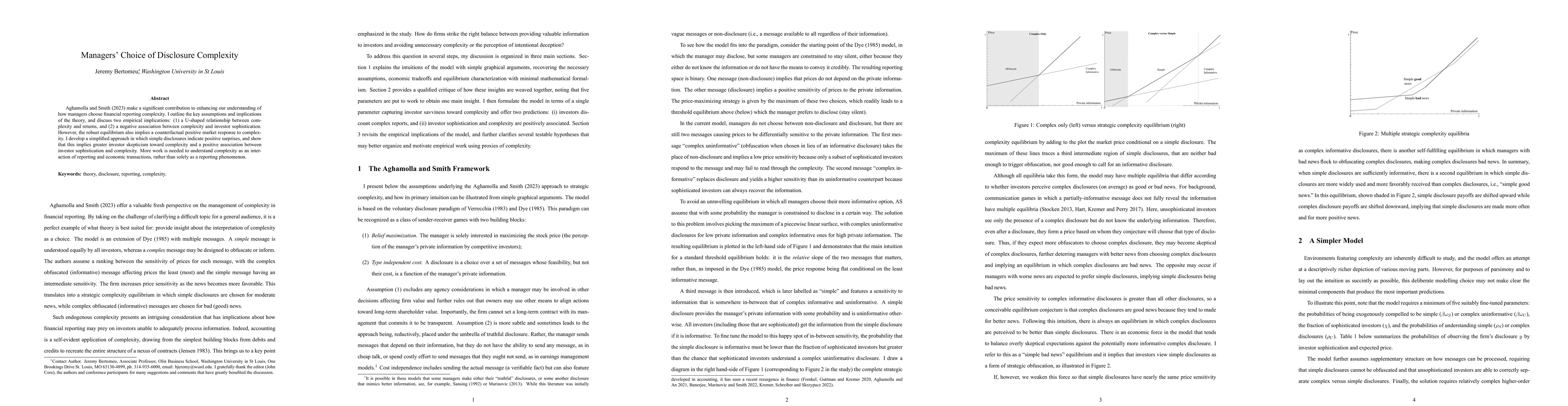

Aghamolla and Smith (2023) make a significant contribution to enhancing our understanding of how managers choose financial reporting complexity. I outline the key assumptions and implications of the theory, and discuss two empirical implications: (1) a U-shaped relationship between complexity and returns, and (2) a negative association between complexity and investor sophistication. However, the robust equilibrium also implies a counterfactual positive market response to complexity. I develop a simplified approach in which simple disclosures indicate positive surprises, and show that this implies greater investor skepticism toward complexity and a positive association between investor sophistication and complexity. More work is needed to understand complexity as an interaction of reporting and economic transactions, rather than solely as a reporting phenomenon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)