Authors

Summary

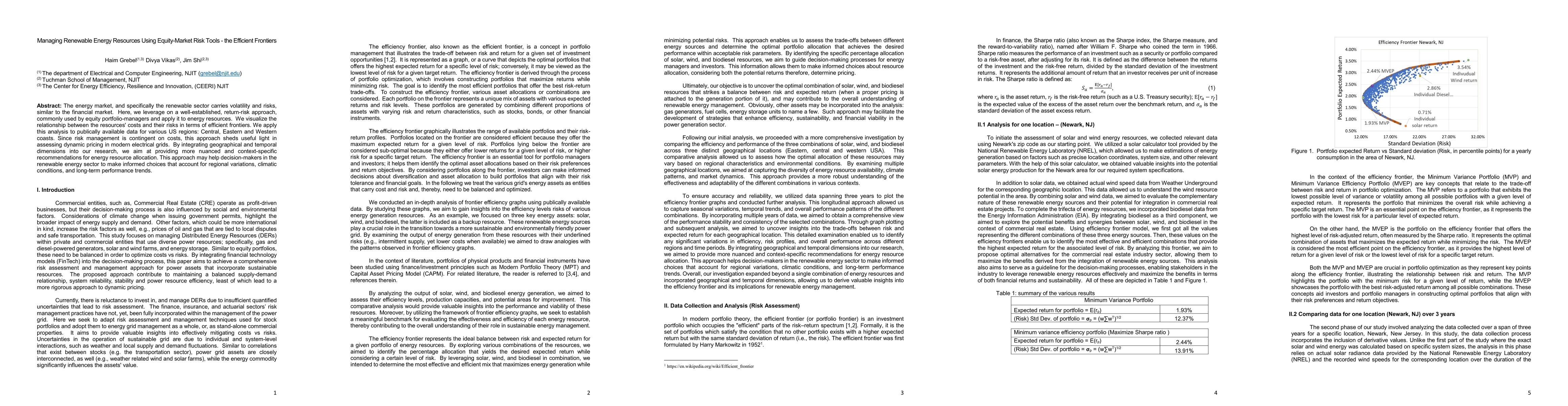

The energy market, and specifically the renewable sector carries volatility and risks, similar to the financial market. Here, we leverage on a well-established, return-risk approach, commonly used by equity portfolio-managers and apply it to energy resources. We visualize the relationship between the resources' costs and their risks in terms of efficient frontiers. We apply this analysis to publically available data for various US regions: Central, Eastern and Western coasts. Since risk management is contingent on costs, this approach sheds useful light in assessing dynamic pricing in modern electrical grids. By integrating geographical and temporal dimensions into our research, we aim at providing more nuanced and context-specific recommendations for energy resource allocation. This approach may help decision-makers in the renewable energy sector to make informed choices that account for regional variations, climatic conditions, and long-term performance trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)