Summary

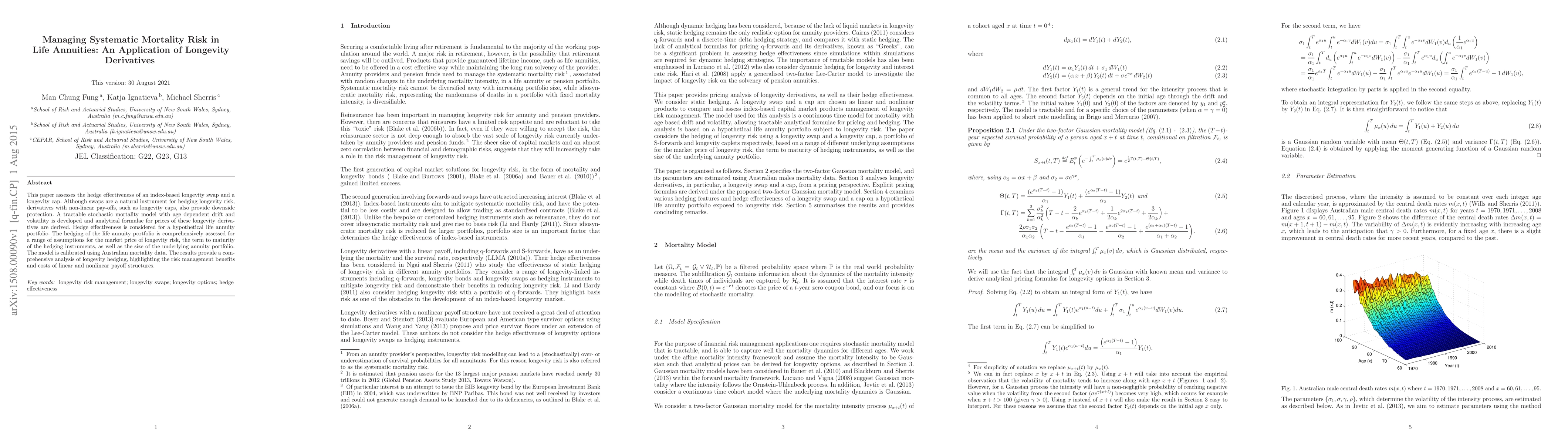

This paper assesses the hedge effectiveness of an index-based longevity swap and a longevity cap. Although swaps are a natural instrument for hedging longevity risk, derivatives with non-linear pay-offs, such as longevity caps, also provide downside protection. A tractable stochastic mortality model with age dependent drift and volatility is developed and analytical formulae for prices of these longevity derivatives are derived. Hedge effectiveness is considered for a hypothetical life annuity portfolio. The hedging of the life annuity portfolio is comprehensively assessed for a range of assumptions for the market price of longevity risk, the term to maturity of the hedging instruments, as well as the size of the underlying annuity portfolio. The model is calibrated using Australian mortality data. The results provide a comprehensive analysis of longevity hedging, highlighting the risk management benefits and costs of linear and nonlinear payoff structures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)