Summary

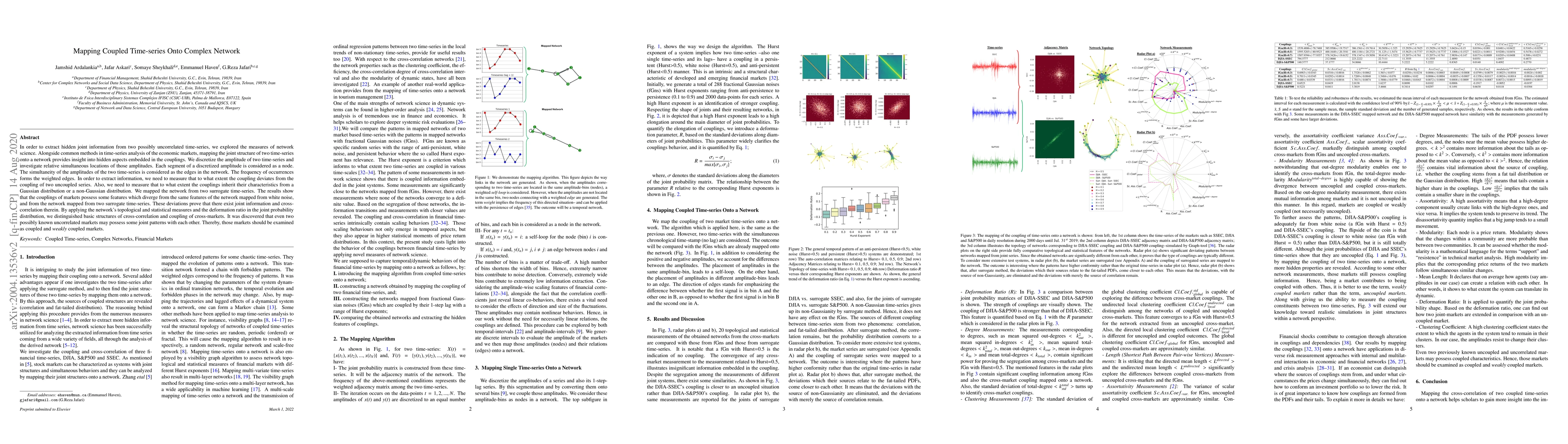

In order to extract hidden joint information from two possibly uncorrelated time-series, we explored the measures of network science. Alongside common methods in time-series analysis of the economic markets, mapping the joint structure of two time-series onto a network provides insight into hidden aspects embedded in the couplings. We discretize the amplitude of two time-series and investigate relative simultaneous locations of those amplitudes. Each segment of a discretized amplitude is considered as a node. The simultaneity of the amplitudes of the two time-series is considered as the edges in the network. The frequency of occurrences forms the weighted edges. In order to extract information, we need to measure that to what extent the coupling deviates from the coupling of two uncoupled series. Also, we need to measure that to what extent the couplings inherit their characteristics from a Gaussian distribution or a non-Gaussian distribution. We mapped the network from two surrogate time-series. The results show that the couplings of markets possess some features which diverge from the same features of the network mapped from white noise, and from the network mapped from two surrogate time-series. These deviations prove that there exist joint information and cross-correlation therein. By applying the network's topological and statistical measures and the deformation ratio in the joint probability distribution, we distinguished basic structures of cross-correlation and coupling of cross-markets. It was discovered that even two possibly known uncorrelated markets may possess some joint patterns with each other. Thereby, those markets should be examined as coupled and \textit{weakly} coupled markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComplex network approaches to nonlinear time series analysis

Jürgen Kurths, Jonathan F. Donges, Norbert Marwan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)