Summary

Motivated by applications in model-free finance and quantitative risk management, we consider Fr\'echet classes of multivariate distribution functions where additional information on the joint distribution is assumed, while uncertainty in the marginals is also possible. We derive optimal transport duality results for these Fr\'echet classes that extend previous results in the related literature. These proofs are based on representation results for increasing convex functionals and the explicit computation of the conjugates. We show that the dual transport problem admits an explicit solution for the function $f=1_B$, where $B$ is a rectangular subset of $\mathbb R^d$, and provide an intuitive geometric interpretation of this result. The improved Fr\'echet--Hoeffding bounds provide ad-hoc upper bounds for these Fr\'echet classes. We show that the improved Fr\'echet--Hoeffding bounds are pointwise sharp for these classes in the presence of uncertainty in the marginals, while a counterexample yields that they are not pointwise sharp in the absence of uncertainty in the marginals, even in dimension 2. The latter result sheds new light on the improved Fr\'echet--Hoeffding bounds, since Tankov [30] has showed that, under certain conditions, these bounds are sharp in dimension 2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

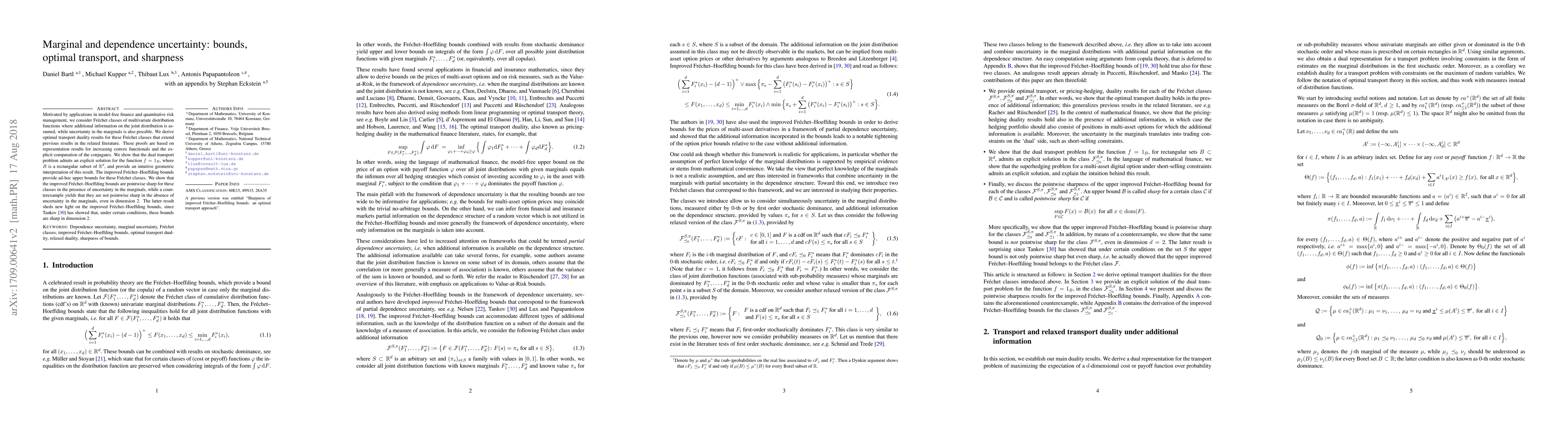

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Dependence Measure using RKHS based Uncertainty Moments and Optimal Transport

Jose C. Principe, Rishabh Singh

Unbalanced Multi-Marginal Optimal Transport

Sebastian Neumayer, Gabriele Steidl, Florian Beier et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)