Summary

In the compagnion paper [Marginal density expansions for diffusions and stochastic volatility, part I] we discussed density expansions for multidimensional diffusions $(X^1,...,X^d)$, at fixed time $T$ and projected to their first $l$ coordinates, in the small noise regime. Global conditions were found which replace the well-known "not-in-cutlocus" condition known from heat-kernel asymptotics. In the present paper we discuss financial applications; these include tail and implied volatility asymptotics in some correlated stochastic volatility models. In particular, we solve a problem left open by A. Gulisashvili and E.M. Stein (2009).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

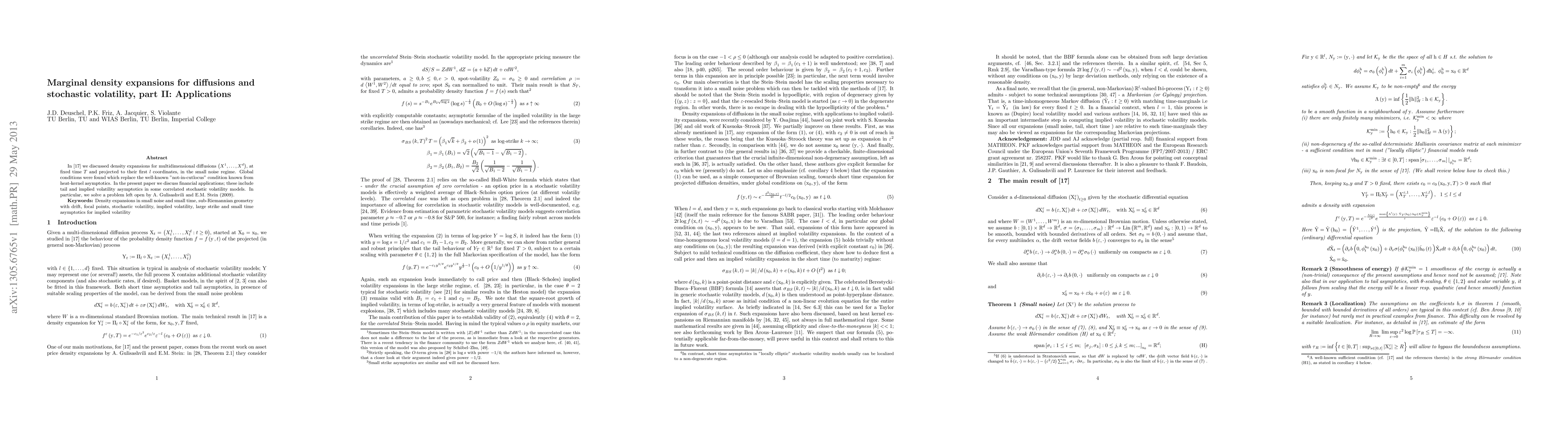

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)