Authors

Summary

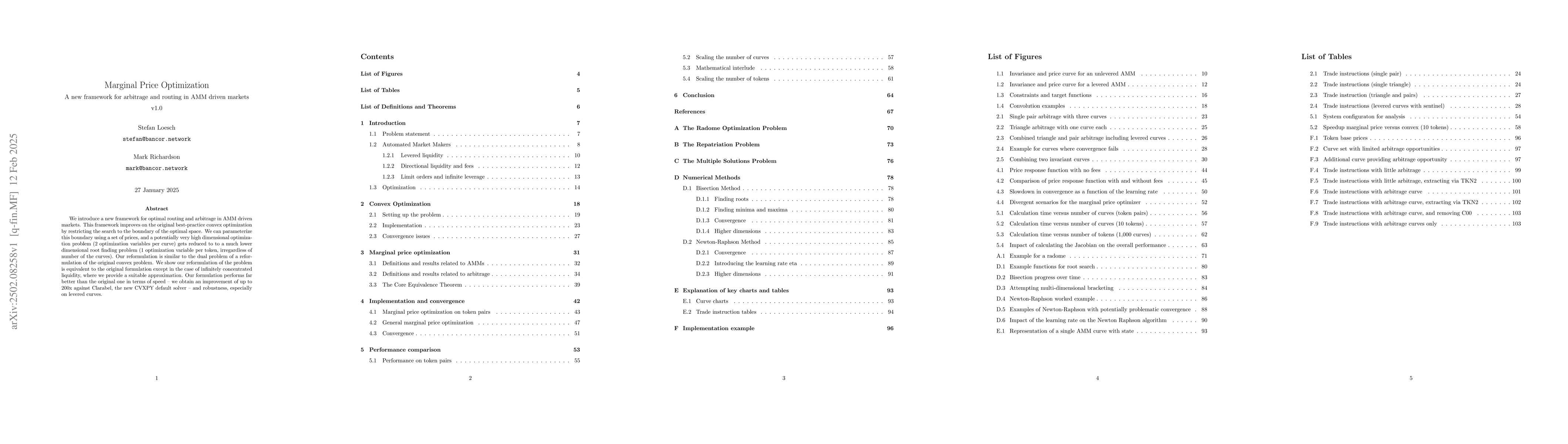

We introduce a new framework for optimal routing and arbitrage in AMM driven markets. This framework improves on the original best-practice convex optimization by restricting the search to the boundary of the optimal space. We can parameterize this boundary using a set of prices, and a potentially very high dimensional optimization problem (2 optimization variables per curve) gets reduced to a much lower dimensional root finding problem (1 optimization variable per token, regardless of the number of the curves). Our reformulation is similar to the dual problem of a reformulation of the original convex problem. We show our reformulation of the problem is equivalent to the original formulation except in the case of infinitely concentrated liquidity, where we provide a suitable approximation. Our formulation performs far better than the original one in terms of speed - we obtain an improvement of up to 200x against Clarabel, the new CVXPY default solver - and robustness, especially on levered curves.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper introduces a new framework for optimal routing and arbitrage in Automated Market Maker (AMM) driven markets by reformulating the convex optimization problem. It reduces a high-dimensional optimization problem to a lower-dimensional root-finding problem, significantly improving speed and robustness.

Key Results

- The reformulation reduces the problem dimension from 2 optimization variables per curve to 1 optimization variable per token, regardless of the number of curves.

- The new formulation outperforms the original convex optimization by up to 200x against Clarabel, the new CVXPY default solver, in terms of speed and robustness.

- The method is particularly effective on leveraged curves, where the original convex optimization struggles.

Significance

This research is significant as it presents a more efficient and robust method for identifying arbitrage opportunities in AMM-driven markets, which can benefit traders and liquidity providers by enabling faster and more reliable arbitrage execution.

Technical Contribution

The paper presents a novel reformulation of the convex optimization problem for arbitrage and optimal routing in AMM-driven markets, transforming it into a root-finding problem with significant computational advantages.

Novelty

This work distinguishes itself by focusing on the boundary of the optimal space, parameterizing it with a set of prices, and reducing the problem dimension, which sets it apart from previous convex optimization approaches.

Limitations

- The method's approximation for infinitely concentrated liquidity might not be suitable for all market scenarios.

- The paper does not extensively cover the practical implementation challenges of deploying this method in real-world decentralized exchanges.

Future Work

- Investigate the performance of the proposed method on a broader range of AMM models and market conditions.

- Explore the integration of this method into existing trading platforms and assess its impact on trading strategies and market efficiency.

Paper Details

PDF Preview

Similar Papers

Found 4 papersIs Locational Marginal Price All You Need for Locational Marginal Emission?

Xuan He, Yize Chen, Danny H. K. Tsang

Data-Driven Inverse Optimization for Marginal Offer Price Recovery in Electricity Markets

Zhirui Liang, Yury Dvorkin

No citations found for this paper.

Comments (0)