Summary

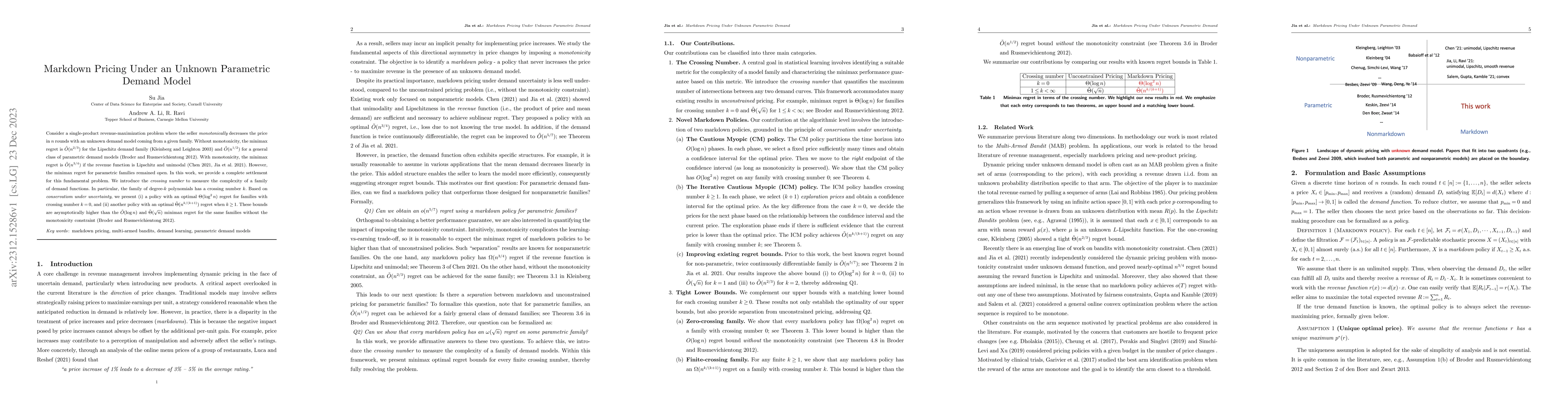

Consider a single-product revenue-maximization problem where the seller monotonically decreases the price in $n$ rounds with an unknown demand model coming from a given family. Without monotonicity, the minimax regret is $\tilde O(n^{2/3})$ for the Lipschitz demand family and $\tilde O(n^{1/2})$ for a general class of parametric demand models. With monotonicity, the minimax regret is $\tilde O(n^{3/4})$ if the revenue function is Lipschitz and unimodal. However, the minimax regret for parametric families remained open. In this work, we provide a complete settlement for this fundamental problem. We introduce the crossing number to measure the complexity of a family of demand functions. In particular, the family of degree-$k$ polynomials has a crossing number $k$. Based on conservatism under uncertainty, we present (i) a policy with an optimal $\Theta(\log^2 n)$ regret for families with crossing number $k=0$, and (ii) another policy with an optimal $\tilde \Theta(n^{k/(k+1)})$ regret when $k\ge 1$. These bounds are asymptotically higher than the $\tilde O(\log n)$ and $\tilde \Theta(\sqrt n)$ minimax regret for the same families without the monotonicity constraint.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic pricing and assortment under a contextual MNL demand

Noemie Perivier, Vineet Goyal

No citations found for this paper.

Comments (0)