Summary

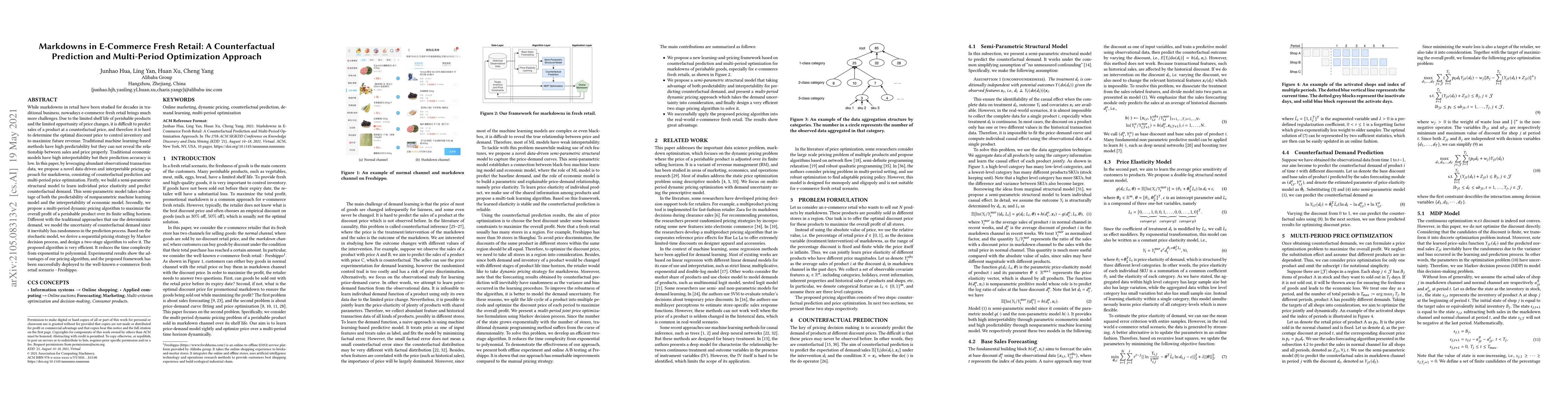

In this paper, by leveraging abundant observational transaction data, we propose a novel data-driven and interpretable pricing approach for markdowns, consisting of counterfactual prediction and multi-period price optimization. Firstly, we build a semi-parametric structural model to learn individual price elasticity and predict counterfactual demand. This semi-parametric model takes advantage of both the predictability of nonparametric machine learning model and the interpretability of economic model. Secondly, we propose a multi-period dynamic pricing algorithm to maximize the overall profit of a perishable product over its finite selling horizon. Different with the traditional approaches that use the deterministic demand, we model the uncertainty of counterfactual demand since it inevitably has randomness in the prediction process. Based on the stochastic model, we derive a sequential pricing strategy by Markov decision process, and design a two-stage algorithm to solve it. The proposed algorithm is very efficient. It reduces the time complexity from exponential to polynomial. Experimental results show the advantages of our pricing algorithm, and the proposed framework has been successfully deployed to the well-known e-commerce fresh retail scenario - Freshippo.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimization of Delivery Routes for Fresh E-commerce in Pre-warehouse Mode

Yun Wang, Alice Harward, Junjie Lin et al.

OTPTO: Joint Product Selection and Inventory Optimization in Fresh E-commerce Front-End Warehouses

Yan Jiang, Zheming Zhang, Qingshan Li et al.

Retail-GPT: leveraging Retrieval Augmented Generation (RAG) for building E-commerce Chat Assistants

Bruno Amaral Teixeira de Freitas, Roberto de Alencar Lotufo

| Title | Authors | Year | Actions |

|---|

Comments (0)